Through this blog you shall become familiar about GST or Goods and Services Tax: Impact of GST on common man. What are the advantages and disadvantages of GST in India. How it will impact our the life of a common man? How the common man will benefit from GST ?

GST or Goods and Services Tax was introduced in July 2017 in India. GST had been a hot topic of discussion everywhere in the year of its introduction. No wonder, it still remains a trending topic to discuss around. Being be aware of different aspects of GST has become all the more essential.

Keep reading further, to have a deeper insight of the positive as well as the negative Impact of GST on common man.

GST or Goods & Services Tax: Facts

Presently, there are around 160 countries that have implemented GST/VAT in some form or the other. In few countries, VAT is the substitute for GST. But, conceptually it is a destination based tax that is being levied on the consumption of goods and services.

- An interesting fact, France was the first to introduce GST or Goods and Services tax.

- Presently, only Canada has a dual GST model.

- The rate of GST normally ranges in between 15–20% only. However, it may differ to a higher/lower side in some of the countries.

The rates of GST play a crucial role in its successful implementation. Various countries have been struggling to rationalize the rate structure.

India finally launched the new GST or Goods and services tax after crossing the various hurdles that came its way.

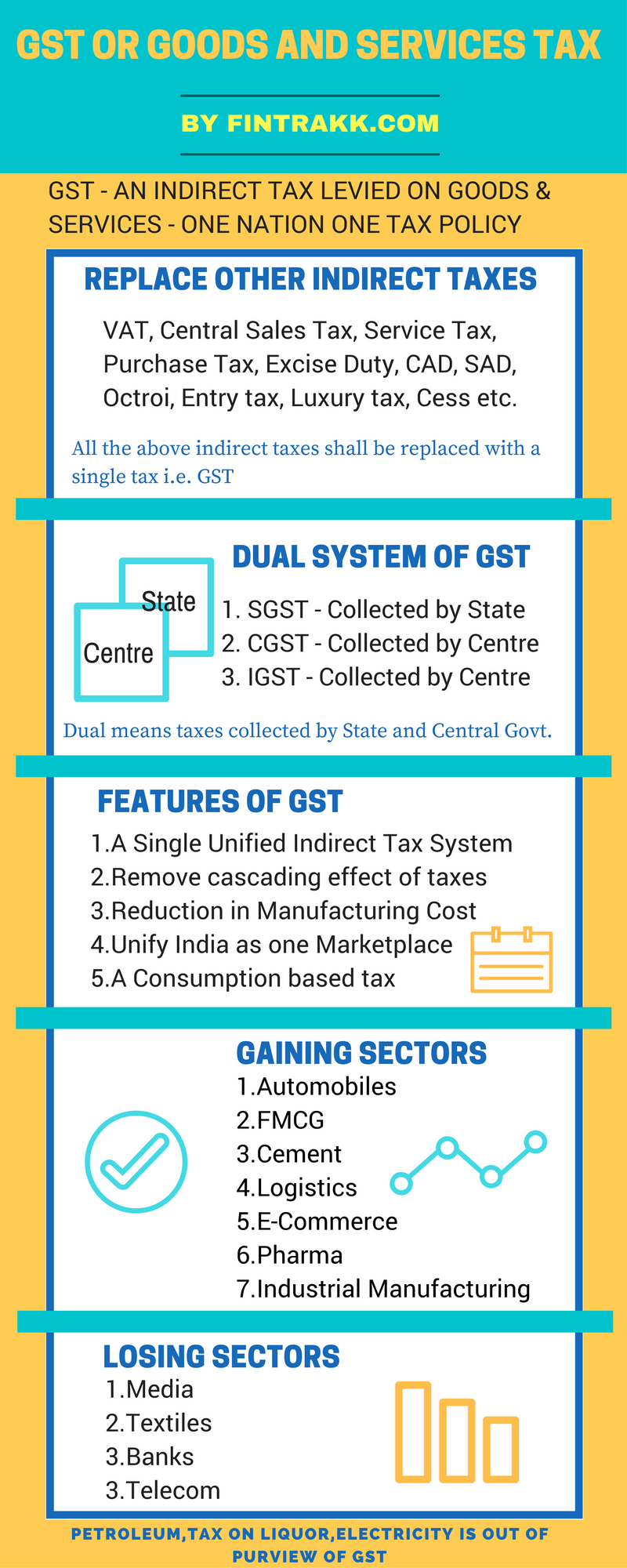

Have a look at the Infographic below, that will give you an overview of GST or Goods and Services tax:

What is GST or Goods & Services tax? What is its Impact on the Common Man ?

GST or Goods and Services Tax as the name implies, it is an indirect tax applied both on goods and services at a uniform rate. This means goods and services will be subject to a uniform tax rate and both will be treated at par.

A single form of tax known as GST or Goods and services tax will be applied throughout the country, replacing a number of other indirect taxes like VAT, Service tax, CST, CAD etc.

GST or Goods and Services Tax – Being a new law, a new tax that brought with it new challenges to face. Hence, this had to be tackled with utmost care.

So, GST bill covered the Goods and Services Tax i.e. the biggest indirect tax reform providing a uniform and simplified way of Indirect taxation in India. GST replaced a number of other indirect taxes like VAT, CST, Service tax, CAD, SAD, Excise, Entry tax, purchase tax etc.

So, a bundle of indirect taxes got replaced by a new tax in India known as GST or Goods and Services Tax. Hence, leading to a much simplified tax regime as compared to the earlier complicated tax structure comprising of numerous taxes.

As and when a new reform or bill comes and a new law is imposed, it surely leaves its impact especially on the common man. It is ultimately the common man who is directly or indirectly affected by the implementation of any new tax.

And this time too there’s was no exception, the common man had to get ready for the implications. Who is the common man here? This includes not only the final consumer of goods but all the small traders and service providers who are directly affected after the introduction of GST.

Here, we have tried to cover up the major points related to Impact of GST on the common man or the final consumer. You shall also know the overall impact of GST.

Simply stated, we have highlighted the main advantages and disadvantages of GST. How GST impacts the common man?

GST Slab rates: On Introduction

- Zero rated items: Foodgrains used by common people. ( A sigh of relief…hmmm…)

- 5% Rate: Items of mass consumption including essential commodities will have low tax incidence.

- 12% and 18 % Rate: Two standard rates had been finalised as 12% and 18%. Most commonly, you’ll hear an 18% rate on different goods and services.

- 28% Rate : White goods like Air conditioners, washing machines, refrigerators, soaps and shampoos etc. that were taxed at 30-31% shall be now taxed at 28%.

Demerit goods like tobacco, tobacco products, pan masala, aerated drinks and luxury cars shall be charged at the highest rate of 28%. An additional cess on some luxury goods shall also be imposed.

Services that were earlier taxed at 15% shall be taxed at a higher rate of GST @ 18%. Various goods have been classified to fit into the above categories.

Important Note: The GST rates given above are a general overview of rates when this new tax system was initially launched. GST rates have been revised on various occasions and might vary on different category of items. Kindly check the respective rates from a tax consultant.

Positive Impact of GST on Common Man: Advantages of GST

- GST was launched as a unified tax system removing a bundle of indirect taxes like VAT, CST, Service tax, CAD, SAD, Excise etc.

- A simplified tax policy as compared to earlier tax structure. However, it was not as simple as it seemed to be, Check disadvantages below to grab more details.

- GST or Goods & Services tax removes cascading effect of taxes i.e. removes tax on tax.

- Due to lower burden of taxes on the manufacturing sector, the manufacturing costs will be reduced. Hence, prices of consumer goods likely to come down.

- Due to reduced costs some products like cars, FMCG etc. will become cheaper.

- This will help in lowering the burden on the common man. You will have to shed less money to buy the same products which were earlier costly.

- The low prices will further lead to an increase in the demand/consumption of goods.

- Increased demand will lead to increase supply. Hence, this will ultimately lead to rise in the production of goods.

- The increased production will lead to more job opportunities in the long run. But, this can happen only if consumers actually get cheaper goods.

- It will curb circulation of black money. This can happen only if the “kacha bill” system, normally followed by traders and shopkeepers is put to check.

- A unified tax regime will lead to less corruption which will indirectly affect the common man.

- Most importantly, experts hope to see a positive impact of GST on Indian economy in the long run.

But, this is possible only if the actual benefit of GST is passed on to the final consumers. There are various other factors also like the sellers profit margin that determine the final price of goods. GST alone does not determine the final price of goods. The anti-profiteering clause has been inserted in the GST Act to protect the interest of the consumers.

Negative Impact of GST on Common man: Disadvantages of GST

- Compliance burden: You need to deposit GST and file returns on time. GST returns filing is not as easy as it seems to be. You need to hire a tax professional to manage it. Although, Government has been taking steps to simplify the returns filing and keep it simple. But, still it will take time to actually smoothen the entire process.

Although big businesses having ample staff can handle the whole process very easily. But, what about small traders/service providers or individuals who have just started their business or service, isn’t that getting a bit complex for them? A small exemption in this regard might be a big sigh of relief for such people!

- Service tax rate @ 15% is presently charged on the services. So, if GST is introduced at a higher rate which is likely to be seen in the near future, the cost of services will rise. GST shall be charged @18% on maximum services and shall reach upto 28% for few services. In simple words, all the services like telecom, banking, airline etc. will become more expensive.

- Increased cost of services means, an add on to your monthly expenses.

- You will have to reschedule your budgets to bear the additional services cost.

- Businessmen and service providers are still learning about the new laws. This will increase reliance on tax experts and professionals and further add to your business expenses.

- Being a new tax, it will take some time for the people to understand it completely. Its actual implications can be seen after a certain period of time.

- It is easier said than done. There are always some complications attached. It is a consumption based tax, so in case of services the place where service is provided needs to be determined.

- Proper invoicing and accounting needs to be done to ensure better compliance. However, GST Accounting Software are being developed in this regard by various companies.

- If actual benefit is not passed to the consumer and the seller increases his profit margin, the prices of goods can also see a rising trend.

- An increase in inflation might be seen initially that may come down gradually.

- A strict check on profiteering activities will have to be done, so that the final consumer can enjoy the real benefits of GST.

- Although, a large number of officers have been trained and a systematic IT software developed for the successful implementation of GST. But, it will take some time for the people including the manufacturers, the wholesalers, the retailers or the final consumers to understand the whole process and apply it correctly.

GST Impact on Common Man

In the year of its launch, a range of GST training and Courses had been provided by the Government, various institutions and companies to educate the people all around.

However, GST or Goods and Services tax is a long term strategy planned by the Government. So, its positive impact shall be seen in the long run only.

A well designed GST Policy can bring a qualitative and real change in the tax system of India.

A massive IT Software has been developed for the successful implementation of GST to bring things online. Revenue officials were also being trained for turning GST into a reality. But, the actual performance and results can be visualised over the years.

Talking about the different sectors, some might have gained, some might have lost. But, ultimately we will have to get used to this new tax. A landmark reform having a great impact on India and its taxation system.

Also read : 10 Best Credit Cards in India: Review!

Let us hope GST or Goods and services tax leaves a positive impact and helps to boost up the Indian economy and convert India into a unified national market with simplified tax regime.

A rising Indian economy will anyways help in the financial growth of the common man!

Conclusion

Let us hope this “One nation, one tax” proves to be a game changer in a positive way and proves to be beneficial not only to the common man but to the country as a whole.

What are your views regarding GST and its impact on the common man? Do you feel it will help the common man? Will it lower the tax burden?

How positively it will impact the life of a common man? Feel free to give your opinion on the same to help our readers learn more about GST! And yes, don’t forget to share it with your family and friends, after all GST an interesting topic that everyone wants to know about.

Also,have a look at one of our most popular blog post on Investments to help you in your right investment planning: 7 Best Long term Investments in India !

View Comments (40)

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

1 2 Next »Hi, Thanks for these useful details.

Till date in various fields GST has impacted negatively on the common man.Our flat owner is asking for 10% extra payment on account of GST. It has a deep impact on prices of different commodities for common man.

Government needs to audit and control how effectively and correctly it is being implemented.Big businesses and big entrepreneurs or business leaders may feel otherwise.

True and concise information and great article on GST. Well done and keep it up.

Good info.A big move for India but faced by initial hiccups.Hope to see some improvement in the coming days.

Yes Jay, this is indeed a big or we can say a massive move.There may be some teething problems which may be overcome in the coming months.

Thanks for sharing such a valuable information to us.But I want to ask that how GST shall impact the SME sector? It will be effective or not.

Hi Annu, Thanks for appreciation ! SME sector shall be affected to some extent.We shall be sharing the sector wise implications in one of our posts.Keep visiting for latest info on GST and other topics.

My understanding is GST will replace all other local taxes charged so far which is covered under MRP in all products we purchased.If it is correct, GST will help to reduce the price majorly, but unfortunately traders are charging GST on top of their existing costs.This has to be reviewed by Govt and people should get benefited out of it.Will it be happen? Million dollar question.

Thanks for a detailed information about GST. Now,we are very clear about GST.

Hi Govinda, Thanks for appreciation.Happy to help.

Why does the govt always harp on the 'corruption' factor alone in every scheme it introduces ?The scheme talks about the reduction in the incidence of the tax at multiple levels; now what I understand is, that the taxes paid out at each phase of production,procurement,manufacture,transport,distribution and consumption, the entities paying taxes (be it CGST, SGST or IGST) gets a credit for the tax paid out by them, except in the phase of 'consumption';that means the tax paid on a single lot, will get reflected in the price of the next batch, only if the entity makes it a point to reduce the amt already paid, and reduce the cost of acquisition by the next stakeholder.How to ensure that this happens? Is there a mechanism to verify the payments and recoveries? What if a firm breaks up its business into multiple parts, so as to keep the turnover of each unit less than the exemption level? I think it will be quite sometime before the rough edges are streamlined and smoothened, before we can say, I have reached the 'destination' of Single Tax Nation.

The people raised voices when BMMC (Mumbai Municipality) wanted to remove octroi/entry tax; but now all the guys involved in the tax recoveries at the check post etc. will find themselves unemployed and deprived of the 'extras'.

Thanks for sharing your views.It may take some time for things to stabilise under the new tax regime.There are initial teething problems which are likely to be overcome slowly and gradually when people get accustomed to the new system.

If I want to deposit or withdraw money from bank, then also I will have to pay GST?

If we think overall,it can make farmers poor and pressurise them,because farmers are already very weak.

Thank you for sharing this information. :)

Thanks for sparing your time and going through our blog.Hope you liked it.Keep visiting to check our latest posts :)

Hello,Thanks for sharing useful details on GST, Awesome stuff !

H Rahul,Thanks for appreciation. Keep visiting our latest blogs.

I suppose that the actual tax on various items and services would have been worked out.Can some one give the comparison as to what are the taxes on specific items, as on today, under the present scheme and under GST? I suppose this might be an informative one.

Actually, in another website eight items have been taken for illustration out of which 5 items show increased taxation. The other items showing less taxation include: (1)Buying of Cars will be cheaper. (2) Buying of LED TV's will be cheaper. These two items are of one time investment type and hence there is no need to be extraordinarily be happy about it. About a third item, a T-shirt costing Rs 1000/-, it is said that the present tax will be Rs 125/- whereas under GST it will be only Rs 120/-!!!! Is a reduction of Rs 5/- a significant one? What is the value of such an amount today?

Even in a roadside tea stall you can't get a cup of tea for Rs 5/-!!!!

I think that as far as the daily needs are concerned, people may not be affected, but the middle class will be definitely affected, because there is taxation in every one of his dealings!!

Hi Nagaraj, Thanks for sharing your valuable feedback.We shall surely update the GST rates in one of our blogs to add to the information of our readers.The cost of various products and services are likely to be increased.While a small reduction might be seen in the cost of few products.But,overall impact can be analysed after its successful implementation.

Hope GST will bring a positive impact in economy, as our country is facing a severe problem of unemployment. GST will help in solving that also hopefully.

Yes,if it helps in solving unemployment, that shall really boost the economy.

GST benefits shall be seen after some time only. It is too early to predict the actual positive impact of GST. Anyways,overall a good post to read on Impact of GST on Common man.Thanks.

Thanks for appreciation ! Yes,its a long run drive and actual impact can be felt after some time only.

Really all information about GST are cardinally momentous, but the thing is that will it be imposed effectively?

We wish for a smooth transition rest we will come to know soon.

Thanks for the information !

Indeed its very informative, same time how common man can bear additional expenses. If the employment is increased no mind to worry.

Any new law is likely to have an impact on the common man.Let us hope this is a positive one.

Thanks for the detailed information

Thanks.Keep visiting for latest updates.

This article is really informative. Thanks and keep sharing such info.

Thanks. Happy to help :) Keep visiting.

I want to ask you a question what will be the effect on manufacturing material of house like cement bricks,sariya iron rods pebbles sand etc whatever is used .

Its prices and will be fall or rise after implementation of GST ? Please tell about it.

Hi,the actual implication is based on the final rate imposed on these materials.The 4 slab rate structure has been decided but the categorisation is still to be finalised.As for now,this might fall under the standard rate of 18%. GST could actually help to lower the cost of construction material.

1.Logistics and warehousing cost is supposed to come down.

2.Cost of manufacturing might also come down.

3.A single tax known as GST will replace other taxes levied like VAT,Service tax,excise duty.

These all can lead to lower construction cost for developers which is likely to be passed on to property buyers.