PAN or Permanent Account no.is a unique 10 digit alphanumeric identity given to any “person” by the Income tax department.It is in the form of a laminated card and serves as an identity proof.Its main objective is to use universal identification for tracking various financial transactions and hence preventing tax evasion.

The government can easily keep a track of all the monetary transactions of various sections of people by linking it to PAN.This is the reason why the mandatory quoting of PAN on various documents and financial transactions has increased over the past few years.

“Person”can be an Individual,HUF,Firm,LLP,AOP,BOI,Company,Trust or Local Authority.

Having a PAN Card is mandatory for anybody who earns a taxable income in India including foreign nationals.But,others can obtain it as a proof of identification or if they are willing to enter into specific transactions that require PAN.

In India,it has been made compulsory to quote your PAN for various activities and transactions like:

- Opening a Bank account.

- While paying direct taxes.

- Filing of Income tax returns.

- Filing of TDS Returns.

- Sale/purchase of immovable property amounting to Rs.10 lakhs or more.

- Sale/Purchase of motor vehicle other than two wheeler.

- Cash payment exceeding Rs.50000 in connection to travel to foreign country.

- Cash Payment of hotel bills exceeding Rs.50000

- Purchase of mutual funds.

- Purchase or sale of goods and services exceeding Rs.2 lakhs per transaction.(Includes jewellery also).

- Payment of Rs.50000 or more for acquiring bonds or debentures.

How to obtain a PAN or Permanent Account Number ?

The government has simplified the procedure for obtaining PAN.

Now you can have a PAN by following these simple steps:-

1. The application for obtaining PAN card can be made in Form 49 A or 49 AA as applicable.

Form 49 A is applicable for :

- Individuals

- HUF

- Companies registered in India

- Firms registered in India

- LLP registered in India

- Associations

- Local Authorities

Whereas form 49 AA is applicable for Individuals who are foreign citizens and firms,LLP and companies registered outside India.The form is to be submitted online on the NSDL website but the proofs are to be sent to NSDL.

2. The application fee can be paid through net banking,credit card,debit card or by Demand draft also.

3. On confirmation,you will get a 15 digit acknowledgement number which can be used to track the status of your PAN application.

4. The acknowledgement duly signed,photographs attached along with Demand draft(if payment not made through any other mode),proof of identity,proof of address and proof of date of birth to be sent at NSDL address.

It usually takes about 15 days to get a new PAN card allotted.

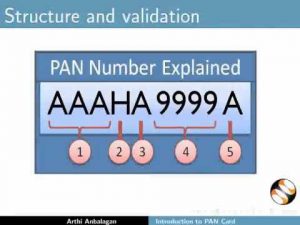

Significance of PAN Card Characters :

Each digit on your PAN card has its own significance which is described as below :

1. The first 3 characters are alphabets in the format AAA to ZZZ alloted randomly.

2. The 4th character is the most significant since it depicts the account holder’s category.

e.g. AAAPK4565L. Here,4th alphabet P stands for Individual.

Thus,4th character indicates

- P-Individual

- F-Firm

- C-Company

- H-HUF

- A-AOP

- T-Trust

- B-Body of Individuals

- L-Local Authorities

- J-Artificial Judicial Person

- G-Government.

3. The 5th character is the first alphabet of account holder’s surname or the last given name.

e.g.If name of Individual is Raj Thakur then 5th character of his PAN will be “T” i.e. first alphabet of his surname.

4. Then come the 4 numeric digits from 001 to 999 that are randomly alloted.

5. The final character is based on a formula that accommodates all the previous 9 characters.

PAN is already a must for various financial transactions.The government further keeps on taking measures to widen its tax base and curb black money.Quoting of PAN is one such step of the government towards a cashless economy wherein all monetary transactions will be through modes other than cash.

So,now you are not left with much choice, you will have to quote your PAN wherever necessary especially in case of financial transactions.There is no way hiding your Income, the government keeps an eye on all your transactions through your Permanent Account Number,commonly known as PAN.

Hence,linking of PAN to almost all important and high value transactions has left no scope for any kind of tax evasion by the assesses.

So,be a good citizen, apply for a PAN Card(if applicable) and comply with the prescribed rules and regulations.

Feel free to give your valuable feedback !

For proper tax planning and timely filing of ITR, you can go through our popular blog posts :

Tax Deduction U/s 80 C -What are 15 eligible Investments ?

10 Documents required for e-filing ITR in India !

If we have PAN Card with us, Can it map to 1 or More than 1 Central/district bank?

If yes, Can we track all the transactions of that person’s bank using PAN.

No,the PAN database is available with Income tax department and they are authorised for doing so.

PAN has been made mandatory at various places so that any major financial transactions are not hidden from the authorities.

Moreover,its not legal if you track someone else’s details.

Now I’m like, well duh! Truly thankful for your help.