Dividend is a payment made by a company to its shareholders usually as a distribution of profits. When a company makes profit it can either re-invest it in the business or it distributes it to its shareholders by way of dividends. The dividend payout ratio is the amount of dividends paid to shareholders relative to the amount of total net profit of a company.

So, are you keen on learning about the popular dividend paying stocks? Some of the best companies paying healthy dividends in the past few years.

Now, let’s dig a bit deeper into it…

Top Dividend Paying Stocks: List to Know

Here we have compiled a list of top 10 dividend paying stocks in India in 2019 (not in any particular order). Of course, it includes the most trending and high dividend yield stocks in India.

1. Indiabulls Housing Finance Limited (2005 – till date)

Sector: Finance Industry: Finance – Housing

About: Indiabulls Housing Finance Limited is a mortgage lender which is headquartered in New Delhi, India. It is India’s second largest housing finance company and is regulated by the National Housing Bank. It is part of Sameer Gehlaut’s Indiabulls group and contributes approximately 80% of the group’s turnover. Its current market capitalisation stands at Rs.18608Cr.

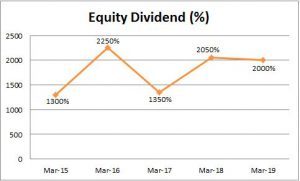

Dividend Info: The company paid Rs. 40 per share in FY 2019, a 2000% return on its face value which is the highest dividend in % terms paid by any company during this financial year.

| Indiabulls Housing Finance Limited | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|

| Equity Dividend (%) | 1300 | 2250 | 1350 | 2050 | 2000 |

| Dividend per share (in Rs.) | 26 | 45 | 27 | 41 | 40 |

2. Balmer Lawrie Investments (2001 – till date)

Sector : Finance Industry: Finance -Investments

About : Balmer Lawrie Investments is a non-banking financial company (NBFC) in which the President of India holds 59.67% of its total paid up equity capital. It does not carry out any business activity, except, to hold the equity shares of Balmer Lawrie & Co. Ltd.

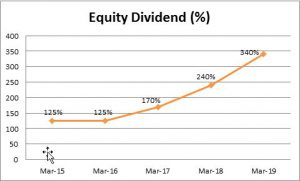

Dividend Info: The company has paid a dividend of Rs.34 per share in the FY19, a 340 percent return on its face value and was among the top five dividend payers in FY18 as well.

| Balmer Lawrie Investments | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|

| Equity Dividend (%) | 125 | 125 | 170 | 240 | 340 |

| Dividend per share (in Rs.) | 12.5 | 12.5 | 17 | 24 | 34 |

You may like to know the difference: Dividend Stocks vs. Growth Stocks

3. Bajaj Holdings & Investment (1945 – till date)

Sector: Finance Industry: Finance – Investments

About: BHIL registered a non-banking financial company (NBFC) is essentially an investment company which holds strategic stakes of 31.54% in Bajaj Auto Ltd. (BAL) 39.29% in Bajaj Finserv Ltd. (BFS) and 24% in Maharashtra Scooters Ltd. (MSL).

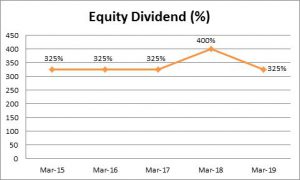

Dividend Info: Bajaj Holdings & Investment is the third highest dividend payer of FY19, paying Rs 32.5 per share, a 325 percent return on its face value. It was the second highest payer in FY18 and third highest in FY17.

| Bajaj Holdings & Investment | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|

| Equity Dividend (%) | 325 | 325 | 325 | 400 | 325 |

| Dividend per share (in Rs.) | 32.5 | 32.5 | 32.5 | 40 | 32.5 |

4. Bombay Stock Exchange (1857 – till date)

Sector: Finance Industry: Finance – Investments

About: The Bombay Stock Exchange (BSE) is an Indian stock exchange located at Dalal Street, Mumbai. Established in 1875, the BSE (formerly known as Bombay Stock Exchange Ltd.) is Asia’s first stock exchange. The BSE is the world’s 10th largest stock exchange with an overall market capitalization of more than $2.2 trillion on as of April 2018.

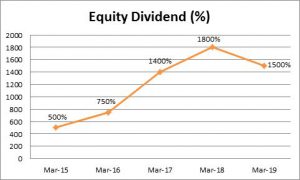

Dividend Info: BSE paid Rs. 30 per share, a 1500 percent dividend on its face value in FY19. In FY18, it was among the top three dividend paying companies.

You may also like: What is Nifty and Sensex in India?

| Bombay Stock Exchange | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|

| Equity Dividend (%) | 500 | 750 | 1400 | 1800 | 1500 |

| Dividend per share (in Rs.) | 5 | 7.5 | 28 | 36 | 30 |

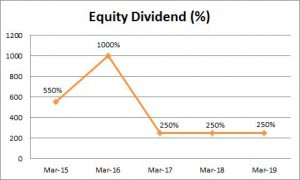

5. Industrial & Prudential Investment Company (1913 – till date)

Sector: Finance Industry: Finance – Investments

About: The Industrial and Prudential Investment Company Limited is a Non-Banking Financial Company (NBFC) engaged in dealing in investments and securities. The Company is engaged in business of acquiring, selling and maintaining investments.

Dividend Info: The Company paid Rs. 25 per share in FY19. It bagged fifth position in the list of top dividend paying companies both in FY18 & FY19.

| Industrial & Prudential Investment Company | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|

| Equity Dividend (%) | 550 | 1000 | 250 | 250 | 250 |

| Dividend per share (in Rs.) | 55 | 100 | 25 | 25 | 25 |

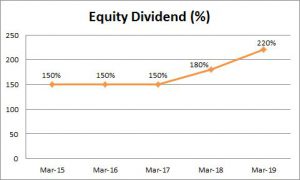

6. Shriram City Union Finance (1986 – till date)

Sector: Finance Industry: Finance – Investments

About: Shriram City Union Finance Ltd is India’s premier financial services company specializing in retail finance. The company is a part of three decade-old Chennai-based Shriram Group India’s premier financial services chain. It is a deposit accepting Non-Banking Finance Company (NBFC) registered with Reserve Bank of India (RBI).

Dividend Info: The Company declared a dividend of Rs 22 per share, a 220 percent dividend on its face value in FY19.

| Shriram City Union Finance | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|

| Equity Dividend (%) | 150 | 150 | 150 | 180 | 220 |

| Dividend per share (in Rs.) | 15 | 15 | 15 | 18 | 22 |

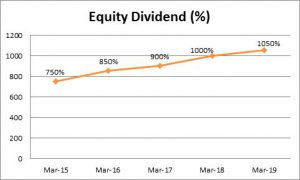

7. Housing Development Finance Corporation (HDFC) (1977 – till date)

Sector: Finance Industry: Finance – Housing

About: Housing Development Finance Corporation Limited (HDFC) is an Indian financial services company based in Mumbai, India. It is a major provider of finance for housing in India. It provides finance to individuals, corporates and developers for the purchase, construction, development and repair of houses, apartments and commercial properties in India. It also has a presence in banking, life and general insurance, asset management, venture capital, realty, education, deposits and education loans.

Dividend Info: HDFC paid a dividend of Rs 21 per share paying 1050 percent dividend in FY19.

| HDFC | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|

| Equity Dividend (%) | 750 | 850 | 900 | 1000 | 1050 |

| Dividend per share (in Rs.) | 15 | 17 | 18 | 20 | 21 |

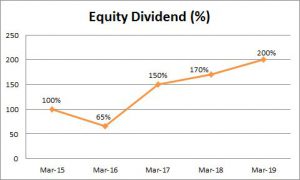

8. Multi Commodity Exchange Of India (2003 – till date)

Sector: Finance Industry: Finance – Investments

About: Multi Commodity Exchange of India is a demutualized Exchange and has permanent recognition from the Government of India to facilitate nationwide online trading, clearing and settlement operations of commodity derivatives. It is an independent commodity exchange which offers options trading in gold and futures trading in non-ferrous metals, bullion, energy, and a number of agricultural commodities.

Don’t miss to checkout: What is Commodity Trading in India?

Dividend Info: MCX paid dividend of Rs 20 per share in FY19 and has been amongst the top 10 dividend paying companies in FY18 also.

| Multi Commodity Exchange Of India | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|

| Equity Dividend (%) | 100 | 65 | 150 | 170 | 200 |

| Dividend per share (in Rs.) | 10 | 6.5 | 15 | 17 | 20 |

9. Tata Investment Corporation (1937 – till date)

Sector: Finance Industry: Finance – Investments

About: Tata Investment Corporation Limited (TICL) is a non-banking financial company. This is primarily involved in investing in long-term investments such as equity shares, debt instruments, listed and unlisted, and equity-related securities of companies in a wide range of industries. TICL invested in numerous sectors, such as banks, cement, chemicals and fertilizers, electricity and transmission, finance and investments, healthcare, hotels, information technology, metals and mining, etc.

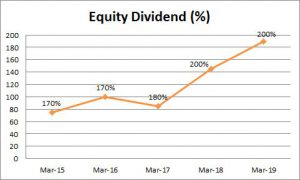

Dividend Info: TICL declared dividend of Rs 20 per share, a 200 percent return on its face value in FY19.

| Tata Investment Corporation | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|

| Equity Dividend (%) | 170 | 170 | 180 | 200 | 200 |

| Dividend per share (in Rs.) | 17 | 17 | 18 | 20 | 20 |

10. Rane Holdings (1929 – till date)

Sector: Finance Industry: Finance – Investments

About: Rane Holdings Limited (RHL) is the holding company of Rane Group. It is a listed company with investments exclusively in the group companies. RHL owns the trademark in Rane and provides a range of services to group companies. These include employee training and development, investor services, business development and Information systems support. Rane Group is engaged in the manufacturing and marketing of automotive components for the transportation industry.

Dividend Info: RHL declared a dividend of Rs 19 per share paying 190 percent return in FY19.

| Rane Holdings | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|

| Equity Dividend (%) | 75 | 100 | 85 | 145 | 190 |

| Dividend per share (in Rs.) | 7.5 | 10 | 8.5 | 14.5 | 19 |

You may also like: Best Career Options in Stock Market

Disclaimer: There is a high degree of risk involved in stock trading. The details given on this website are for informational purpose only and cannot be constituted as professional advice in any regard. Please follow due diligence while investing your money.

So, these are the top dividend paying stocks as per my research. Did I miss any important name in my exclusive collection of some of the best and high dividend paying stocks in India? Do share your opinions and feedback thereon.