We have discussed a lot about Zerodha stock broker in our previous posts. And, why not, it is one the leading and most popular discount brokers in India. So, here we shall highlight and learn about the Zerodha Brokerage Calculator. You can easily calculate the total charges to pay on your trading. Know how much brokerage you will pay on equity, currency & commodity trading through this smart Brokerage Calculator.

Zerodha Account Opening:

First of all, you need to have an online Trading account to enter the dynamic and robust trading world.

A quick look at the Zerodha Account Opening fees and other charges:

[table id=89 /]

A Quick Link to Open Free Equity Investment Account with Zerodha

Zerodha Brokerage Calculator:

Do you know that Zerodha has a quite affordable pricing structure? You enjoy free equity delivery trade and Rs.20 only for equity intraday, Futures & Options and Commodity trades also.

Now, we shall emphasize on the Zerodha Brokerage Calculator. How to use it? You will get a complete breakdown of the brokerage charges, STT, other charges as applicable for a particular trade across NSE, BSE, MCX, MCX-SX.

Before diving into the Brokerage Calculator, let’s have a look at the important terms used for this:

1. Segment:

Which segment you want to deal with? These are categorise as:

- Equity Intraday

- Equity Delivery

- Equity Options

- Equity Futures

Since different brokerage charges apply for different segments, so you need to select the correct one to reach the actual cost & profit.

[maxbutton id=”1″ url=”https://fintrakk.com/recommends/zerodha-brokerage-calculator” text=”Try Zerodha Brokerage Calculator for Free” nofollow=”true” ]

2. Price

- Buy Price: It is the price at which you buy a share, commodity or currency.

- Sell Price: It is the price at which you sell a share, commodity or currency.

3. Quantity:

The number of shares you wish to buy or sell in the stock market.

4. Stock Exchange

- NSE: National Stock Exchange of India

- BSE: Bombay Stock Exchange

You may be interested in learning about NIFTY and Sensex.

5. Brokerage

[table id=55 /]

6. Other Charges

- STT or Securities Transaction Tax: This is the tax that Government charges when you transact on stock exchange. This is charged on both buy and sell sides for equity delivery. While STT is charged only on sell side when you trade intraday or on F&O.

- Exchange Transaction Charges: These are the charges by NSE, BSE and MCX.

- GST or Goods & Services Tax: Government levies GST on Brokerage + Transaction Charges.

- SEBI Charges: These are charged by SEBI for regulating markets.

- Stamp Duty: This is charged State wise as applicable.

After all, you have the right to get details on the charges that you will have to bear while trading. Especially if you are a newbie in stock trading and wish to gain more insights of the stock market world.

You may also like: How to apply for Online IPO with Zerodha through UPI app?

Now, simply calculate your cost upfront by using the comprehensive Zerodha Brokerage Calculator.

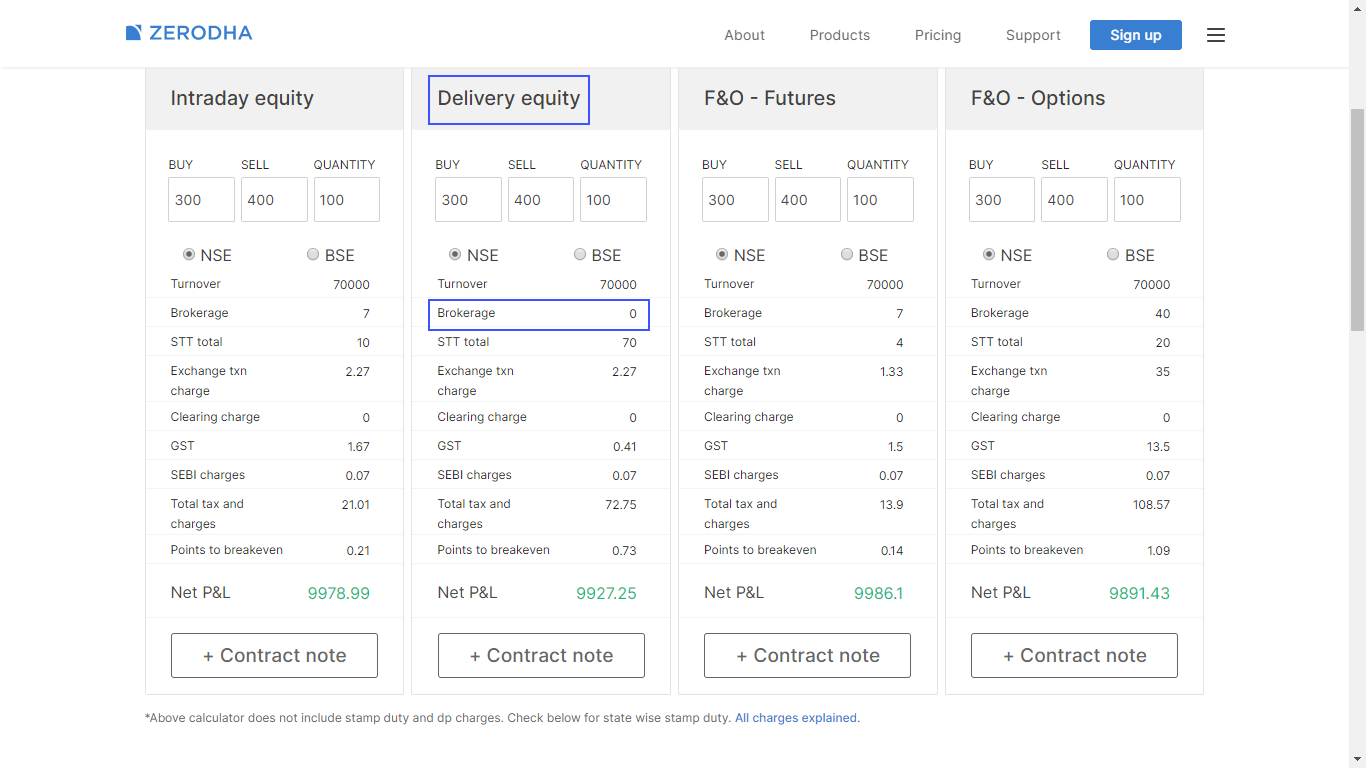

Here’s a screenshot of What Zerodha Brokerage Calculator looks like:

Source: Zerodha

You simply have to choose the segment, put the numbers in “Buy”, “Sell” and “Quantity”. Select the stock exchange you are trading on “NSE or BSE” and here you go. The rest things the calculator manages and gives you the result for the “Net P&L”.

To calculate the brokerage amount, you can simply visit:

[maxbutton id=”1″ url=”https://fintrakk.com/recommends/zerodha-brokerage-calculator/” text=”Zerodha Brokerage Calculator” nofollow=”true” ]

Brokerage Calculation Example:

To explain it, we have assumed for each category:

- Buy Price: Rs.300 only

- Sell Price: Rs.400 only

- Quantity: 100

So, once you fill in these details, this calculator lets you know:

- Brokerage amount

- Other charges

- Profit or Loss

Similarly, you can put values for Currency or commodity to get answers to your brokerage queries.

Note: As highlighted in the image above, Brokerage on Equity Delivery is NIL. So, if you fill details therein, by default brokerage shall be reflected as zero.

Features of Zerodha Brokerage Calculator:

- It’s quite and easy to use Brokerage Calculator.

- All the terminologies and charges have been explained nicely.

- Nothing is hidden and you can straight away know how much brokerage you have to pay.

- You also derive results for the Net Profit or Loss you will earn from the stock transaction.

If you still haven’t opened a Demat and Trading account, here’s a chance open it quickly with one of the largest stock brokers in India.

[maxbutton id=”2″ text=”Apply Now for Zerodha Account” window=”new” ]

The share market is quite regulated these days. Stock brokers are trying to take every possible step to ease out the trading process for their clients.

Disclaimer: There is a high degree of risk involved in stock trading. The details given on this website are for informational purpose only. These should not be constituted as professional advice in any regard. Please follow due diligence while investing your money.

Want to know in detail about this topmost discount broker in India, you can have a complete Zerodha Review: Features, Brokerage, Benefits & much more.

Have yo tried using the Zerodha Brokerage Calculator? How do you like the services of Zerodha or any other stock broker in India? Feel free to share your feedback thereon.

5