In normal day work, we see all the settlements happening in front of us with 100% transparency. As I bought my groceries from the market today, I paid cash and got my goodies and the settlement cycle was complete. This struck my curiosity of how a trade gets executed, cleared, and deposited in my Demat account. So, here I share my research and knowledge on how the stock trade settlement cycle goes on and the usual trading process is carried in India. Quite Interesting!

Stock Trade Settlement Process: Key Steps

Let’s us together try and understand the intricacies of stock trade settlement cycle in India.

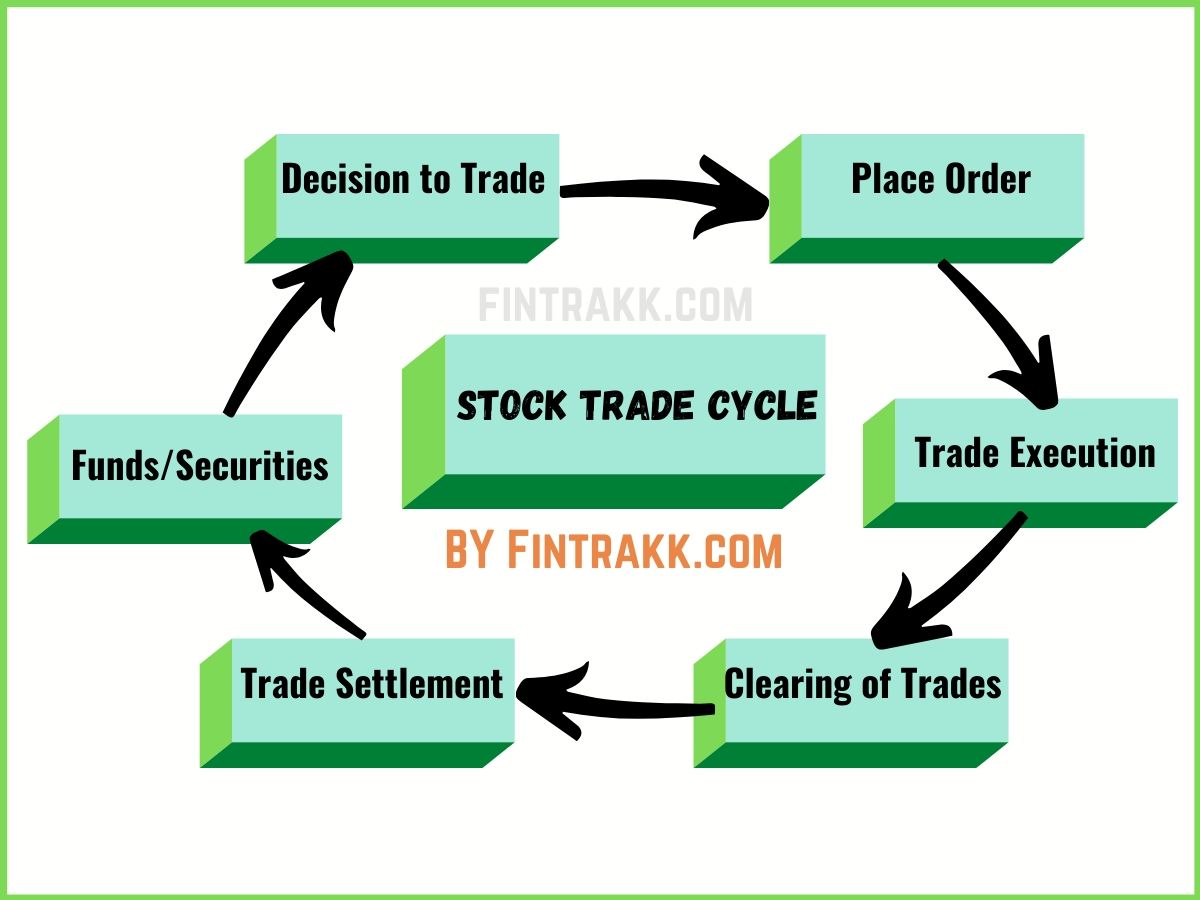

Trade Cycle in India:

When a trader buys or sells stocks, the stock market follows a settlement cycle known as “T+2”. The day when the transaction or trade is made is titled “Trade Date” or “T”, and every working day after that day is reported as T+1, T+2, and so on. In India, the payout is done on the T+2 day and weekends or exchange holidays are not incorporated into it.

From an investor’s point of view, let’s explain this with an example:

Suppose Rita purchased 100 shares of a company on Wednesday, priced at Rs. 500/share. According to the above rule, Wednesday is termed as “T” and Rs. 50,000 is deducted from her account to pay for the transaction. And the broker gives her a “contract note” as a proof. On T+1 day, the internal processing is done and by T+2 day, she can see the shares in her Demat account.

However, if instead of buying, Rita is selling the shares, in that scenario, the shares shall be blocked and moved out of her Demat account prior to T+2 day. Finally, on T+2 day, the sale proceeds will be credited to Rita’s trading account.

You may also like: Best Demat and Trading Account in India

Now, let us uncover what happens during the processing phase, which many traders might be unaware about.

Trade Execution, Clearing & Settlement Process:

Here are some important details about the trade settlement cycle India.

1. Execution

After the order to buy or sell is performed, which means that the buyer and seller have come to a consensus on the price and quantity to trade. The stock broker then fulfills the requirement with the exchange and the order is said to be filled.

2. Clearance:

This process is managed by a “clearing house” whose primary job is to identify the trade, record its details, confirm, verify the obligations of the parties involved, and assess the risk involved. The activities happen on the “T+1” day.

3. Settlement:

On the “T+2” day, the transacted shares are transferred into the buyer’s Demat account and money is moved to the seller’s trading account. Now, when the buyer receives the securities and the seller gets the payment, the trade is said to be settled.

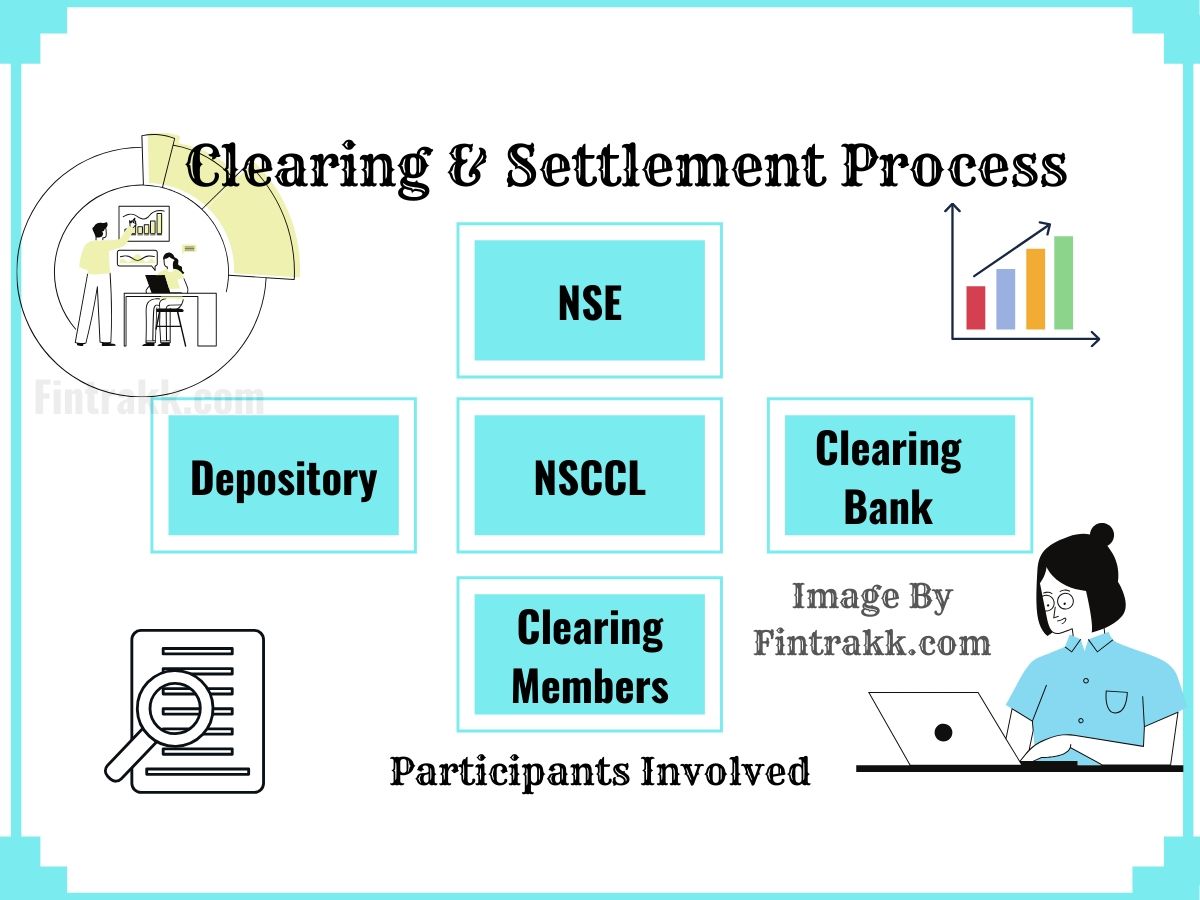

Stock Trading & Settlement: Role of Participants involved:

While Stock exchange offers you a platform to trade, the role of other participants is equally important in the stock trading cycle.

1. Clearing Corporation:

Its responsibilities are to clear and settle the trades executed at the exchange, as well as risk management. The National Securities Clearing Corporation Limited (NSCCL) is a wholly owned subsidiary of the National Stock exchange and was initiated in the year 1995. It is also entrusted to maintain a tight risk containment system and risk guarantee.

2. Clearing Members:

Their task is to ensure that clearing and completion of all deals executed are done. That means, determining positions to settle and performing settlement of the funds. It is also responsible to set position limits based on upfront deposits, margins for trading members, and monitoring positions on a continuous basis.

Also read What is Nifty and Sensex? Meaning

3. Clearing Banks:

Clearing banks allow you to settle funds. Each clearing member is required to open a clearing account with one of the authorized clearing banks.

At present, there are 15 clearing banks namely: Union Bank of India, State bank of India, Kotak Mahindra Bank, Standard Chartered bank, JP Morgan Chase Bank, Indusland bank, IDBI Bank, ICICI bank, HSBC Bank, HDFC Bank, Canara Bank, Citibank, Bank of India, Axis bank.

I hope, I didn’t miss out any important name here! Do let me know! Clearing members operate accounts with any of these banks, exclusively for clearing pay-outs or pay-in associated with the agreement operations.

4. Depositories:

The clearing member holds a clearing pool account with the depository participant or depositories, where they are responsible to produce the obligated traded securities on the settlement day. There are two depositories in India, namely National Securities Depository Ltd (NSDL) and Central Depository Service Ltd (CDSL).

5. Depository Participants:

A Depository Participant (DP) is an intermediary between the depositories (NSDL and CDSL) and investors. Simply stating, you can’t directly open an account with Depositories. This is when a Depository Participant (DP) comes in! You can open a Demat account through a DP (usually your broker) to initiate your investing and trading interests. A financial entity that fulfills the eligibility criteria of SEBI for proving demat related services can become a DP.

Hence, a DP acts as an agent of the depositories. Have you heard of popular stock brokers in India? Zerodha, Angel Broking, Sharekhan, Upstox, etc. are some of the popular depository participants in India.

Clearing & Settlement Process: A Quick Overview

- Details of the trade are transferred from exchange to NSCCL.

- Details of the trade are transferred from the NSCCL to the clearing members, who revert. Based on the information received, the necessary commitment is determined.

- The clearing members then receive pay-in the advice of funds or the securities commitment by the NSCCL.

- The clearing members then issue instructions to the clearing banks for the required funds or to the depository participant in case of transfer of shares.

- Based on the commitment, NSCCL chooses the required step for the pay-in and pay-out of funds and securities.

- The depositories inform clearing members through DPs.

- Finally, the clearing banks are expected to inform the clearing members of the respective details.

I know, these trade settlements are a bit more complex than our daily mundane transactions. But, knowing the processes that take place in the background are really helpful. After all, you may be eager to know how the stock market works in the real sense.

You may also like Intraday Trading vs. Delivery Trading: What’s the Difference?

The author of this post is a stock enthusiast and likes sharing her knowledge to create financial awareness.

No doubt, this article will form a firm base for your understanding of the stock market trade settlement cycle. Do you wish to add some extra information that can add value to our readers and make them learn more about stock market? Feel free to discuss!

4.5