Are you a salaried employee? If yes, you might be interested in knowing few simple but important details about Form 16 or TDS Certificate. After going through this blog, you shall probably get an answer to all your queries relating to Income tax Form 16, its meaning, a look at Form 16 Format and Importance of Form 16 in e-filing your Income tax return.

What is Form 16?

Form 16 is an Income Tax certificate under section 203 of the Income Tax Act, 1961 provided by the employer to their employees in India. This form is required for any salaried class people to file their income tax returns. It is commonly known as TDS Certificate also.

The form carries the details of tax deducted or TDS (Tax Deducted at source) that has been deducted by the employer on behalf of an employee who falls under the Income Tax bracket.

Form 16 is issued once a year on or before 31st May of the next year immediately following the financial year in which tax is deducted. If an employee doesn’t fall under Tax brackets, then he/she will not be issued Form 16 and is exempt from paying tax or TDS.

Components of Income Tax Form 16 or TDS Certificate:

- The personal details of the employee like name, address, PAN etc.

- The employer details like Name, Address, PAN of the deductor, Tax deduction and collection Account Number (TAN), etc.

- Details like Assessment year and period of deduction.

- An acknowledgment number of the taxes paid by the employer.

- Details of the salary; Gross salary, net salary, deductions, perks etc.

- Total income and taxes paid.

- Education cess and surcharge details.

- Taxes deducted under sec. 191A.

- Any deduction under sections 80C, 80CCC and 80CCD.

- Declaration of tax payments from the employer.

- Receipt of the TDS paid.

- All details of the Tax Payment, like Challan number, cheque number, Demand Draft number etc.

Are you interested in stock trading, do have a look at Best Demat and Trading Account in India

Form 16 is divided into two parts: FORM 16 Part A and Part B

Part A includes

- Name and address of the employer and employee.

- TAN & PAN of employer and employee.

- Assessment Year.

- Period of employment with the employer.

- Summary of the tax deducted at source & deposited quarterly.

- Part A of Form 16 also has a unique TDS Certificate Number.

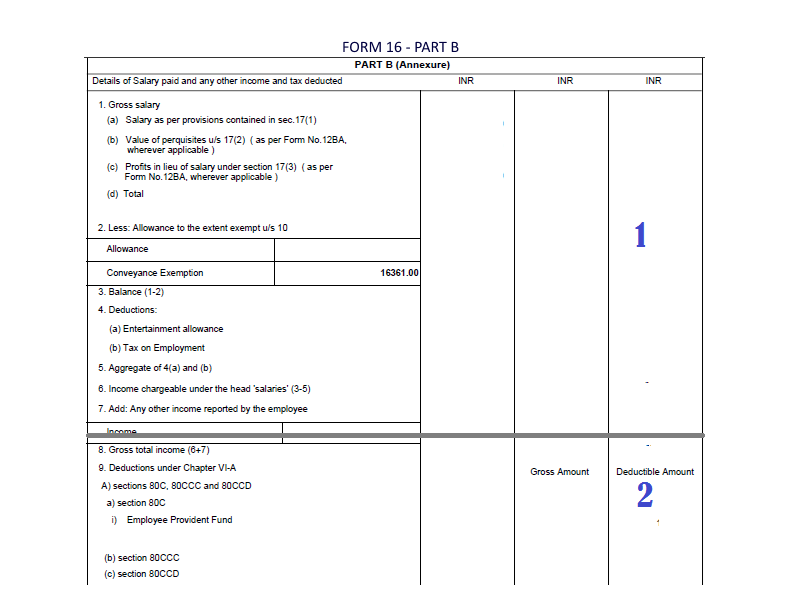

Part B includes

- Breakup of salary paid by the employer.

- Tax Deductions allowed under The Income Tax Act (under Chapter VIA).

- Details of deductions made by the employee under Section 80C.

- Relief under section 89 if any.

- Details and value of perquisites and Declaration by the employer on Form no. 12BA attached with Part B.

- If you have held more than one job during the year, you shall have more than one Form16 issued from both your employers.

Part A must be generated and downloaded from TRACES portal and Part B is prepared by the employer manually and is issued along with Part A.

Details of Part B

- Total Gross Salary.

- The total deduction made under Section 80C and qualifying amount.

- Aggregate deductible amount under Chapter VI- A.

- Total tax deducted.

- Net Tax payable/ Refundable.

Latest Updates on Form 16 for the Financial Year 2019-20

Due to this pandemic crisis, the Indian government provides relaxation for tax-related time limits, including Form 16. In the view of relaxation, employers could issue Form 16 to employees, at the last 15th of August 2020. Although, for Income Tax Return filing the due date of the financial year 2019-20 has been extended to 30, November 2020. The salaried individuals who still have not got the Form 16 due to the employers who have not filed the TDS, they now have sufficient time till the end of November month to file their income tax returns.

According to the norm, Form 16 must be issued to employees within 15th July of every year. However, this pandemic has disintegrated financial plans throughout the global. In fact, the relaxation in the tax-related timeline helps taxpayers in planning for their investments.

Frequently asked questions (FAQs)

Q. How to get or download Form 16?

A. Form 16 is provided by the employer. Even if you have left your job, your employer will provide you a Form 16. However, you cannot download Form16 yourself from anywhere. The employer has to issue it to his employees.

Therefore, no individual can be allowed to download Form 16 by any platform. It can only be accessed to download or issued by the employer. In case you have left your job then also your employer will issue Form 16 to you.

Q. If I don’t have my Form 16 then how can I proceed to file my Income tax return?

A. Form 16 is the most important income tax form for salaried class people, but if you don’t have your Form 16 you can still file your income tax return. You need to calculate your total income manually from your pay slip, get your tax credit certificate Form 26AS (download from TRACES website), fill in the necessary details as required, claim the tax deductions under section 80C as applicable, check for any tax payable and then file your ITR.

Q. Who is eligible for Form 16?

A. According to the Finance Ministry of Government of India, all salaried persons whose tax has been deducted by the employer at source, or whose income falls under the tax-exemption limit which is defined by the Income Tax Department are eligible to get Form 16.

Q. Why is Form 16 required?

Basically, it is a valid proof of certificate that the salaried person submitted the money to the respective authorities what it deducted as a TDS from their annual salaries.

Q. When is Form 16 issued to employees?

The employee needs to issue Form 16 on or before the 31st May of the assessment year, so that employee gets sufficient time to file a return before the due date. Therefore, the assessment year is the particular year in which income is taxed.

Q. What if you have changed your job?

In the event that you have changed your job in the course of the financial year or have worked with multiple companies simultaneously and tax has been deducted at all companies, in this case, you will have to get separate Form 16 from every company. Although, if your respective company did not deduct any tax at source from your salary and take into consideration that your yearly income is below the tax-exemption limit, the company will not issue Form 16.

Q. If I receive my pension through a bank who will issue Form16 to me : the bank or my former employer?

A. The bank will issue you Form 16 in such a case.

Q. If there is no TDS applicable is the employer still required to issue a Form 16 to the employee?

A. The liability to issue TDS certificate or Form 16 is there when the Tax has been deducted at source i.e. TDS is applicable. In case no tax has been deducted by the employer, then the employer may not provide you a Form 16.

Q. When the employer deducts TDS and does not issue Form 16 ?

A. A company or person who is responsible for paying salaries is required to deduct Tax at source or TDS before making such payment, if your salary is taxable after taking into account your investments (after taking into account the investment declaration made by you).

Income Tax Act clearly lays down that the TDS should be deducted from the salary and the deductor must furnish a TDS certificate known as Form 16 with all the relevant details ( Part A and Part B as discussed above).

Q. If no Form 16 has been issued to me does it mean that I don’t have any tax liability as such ? Further, do I need to file my Income tax return ?

A. The liability to deduct tax on salary and provide Form 16 is on the employer, however the duty of paying your income tax and filing your Income tax return is on you. You have an equal responsibility to comply with the tax rules.

So, in case your Total income from all the sources exceeds the minimum tax exemption slab, you are liable to pay tax whether or not your employer has deducted tax at source (TDS). Further, if the employer fails to issue you a Form 16, you must file your Income tax return before due date.

You may also like : Form 15 G & Form 15H -When to submit and avoid TDS ?

Form 16: Importance

It is not the only document which you require to file your yearly income tax return, but it is one of the most important documents for filing your tax return. This income tax certificate enables the employees to effortlessly prepare the income tax return, with or without any support or interference of financial planners and chartered accountants.

Now, the next time you receive Form 16 from your employer, you shall be aware of what it signifies and how much importance it has for a salaried employee. You don’t need to be an expert to understand all these details of Form 16. These are simple basics on Form 16 that will surely help you.

We hope that the above information will be helpful for every employee in knowing how their Form 16 ought to appear and always be aware to get it replaced in case of any discrepancy. Questions and remarks are constantly welcomed.

Feel free to share your valuable feedback and any queries thereon. If you liked it, don’t forget to share these exclusive details on Form 16 especially with your family and friends !

Nice content, It is definitely very helpful for my professional workers. I have got good knowledge from your blog.

If I have two salary sources 1 employer issued me TDS certificate.But, another employer did not issue because no tds detected there.Then,how should I file ITR.

Hi Vaibhav,If you have salary from two employers,you need to include the salary from both of them in your ITR. Add up the amounts received from both of them to calculate your total salary.Claim exemptions as applicable.The exemptions like HRA if received from both employers should be taken proportionately.e.g.You receive HRA from Employer 1 and Employer 2.You worked for 4 months with 1 employer and 8 months with the other employer.Total HRA exemption claimed should not exceed the period of 12 months.

Add up your other incomes and claim tax deductions, if any and show the TDS amount in the form.If any tax is payable,you need to pay it firstly,show the self assessment tax in your ITR form and then file your ITR.