Through this post, we shall be updating you with the New Interest Rates on Post Office Schemes. The interest rates keep on getting revised every quarter. And, you might be keen on learning the latest interest rates on different Post office Savings schemes in India. So, we thought of sharing data related to present interest rates alongwith rates for the previous quarters as well.

This can help you know the recent changes in Post office interest rates. Therefore, you can make a comparison of fluctuations in the Post Office new interest rates and old interest rates.

So, don’t miss to checkout our Post Office Interest rates Comparison table as you read further.

In fact, we shall be adding new interest rates every time there’s any revision to it. So, keep visiting to grab useful information on Post Office Saving Schemes and interest thereon.

Post Office Saving Schemes:

Post Offices in India offer a set of popular investment schemes. You can choose the one based on your financial priorities.

Firstly, let’s know the various Post Office Saving Schemes offered in India:

- A Post Office Savings Account

- Post Office Time Deposits (TD)

- Post Office Recurring Deposit (RD)

- Public Provident Fund (PPF)

- Post Office National Savings Certificate (NSC)

- Post Office Kisan Vikas Patra (KVP)

- Post Office Monthly Income Scheme (MIS)

- Senior Citizen Savings Scheme (SCSS)

- Sukanya Samriddhi Yojana (SSY)

Now, that you know the different schemes provided by India Post offices, let’s go through the latest interest rates.

New Interest Rates on Post Office Schemes: Table 2020

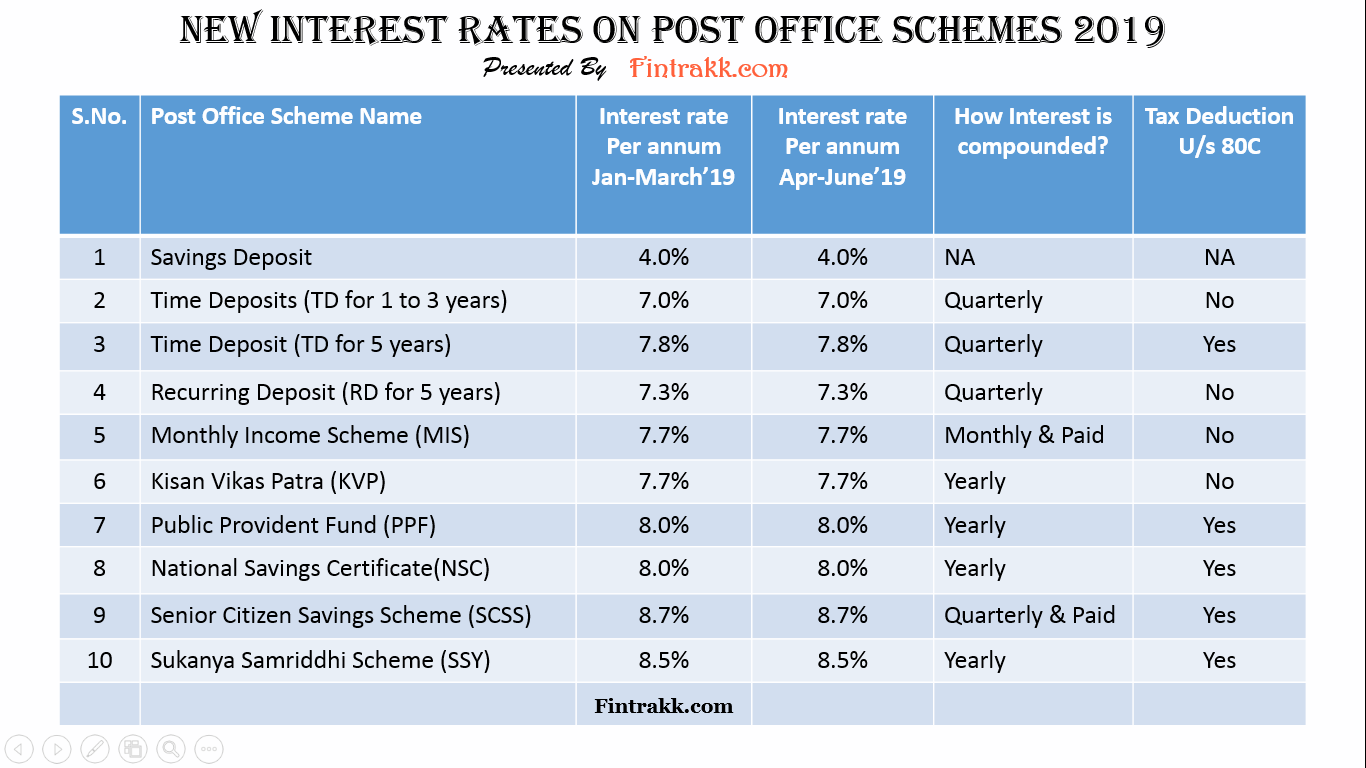

The interest rates on Post office schemes for the first quarter of financial year 2019-20 i.e. 1st April to 30th June 2019 remain unchanged. This means, same rates apply as for the previous quarter of January to March 2019.

So, let’s begin with the new interest rates on post office schemes:

| Post Office Savings Scheme | Interest rate 1st Apr-30th June'20 | Interest rate 1st Jan-31st March'20 | Interest rate 1st Oct-31st Dec'19 | Interest rate 1st Jul-30th Sep'19 | Interest rate 1st Apr-30th Jun'19 | Frequency of Compounding | Tax deduction U/s 80C |

|---|---|---|---|---|---|---|---|

| Post Office Savings Account | 4% | 4% | 4% | 4% | 4% | Yearly | No |

| Post Office Recurring Deposit Account (RD) | 5.8% | 7.2% | 7.2% | 7.2% | 7.3% | Quarterly | No |

| Post Office Monthly Income Scheme (MIS) | 6.6% | 7.6% | 7.6% | 7.2% | 7.3% | Monthly and paid | No |

| Post Office Time Deposit - 1 year | 5.5% | 6.9% | 6.9% | 6.9% | 7% | Quarterly | No |

| Post Office Time Deposit - 2 years | 5.5% | 6.9% | 6.9% | 6.9% | 7% | Quarterly | No |

| Post Office Time Deposit - 3 years | 5.5% | 6.9% | 6.9% | 6.9% | 7% | Quarterly | No |

| Post Office Time Deposit - 5 years | 6.7% | 7.7% | 7.7% | 7.7% | 7.8% | Quarterly | Yes |

| Kisan Vikas Patra (KVP) | 6.9% | 7.6% | 7.6% | 7.6% | 7.7% | Yearly | No |

| National Savings Certificate (NSC) | 6.8% | 7.9% | 7.9% | 7.9% | 8% | Yearly | Yes |

| Public Provident Fund (PPF) | 7.1% | 7.9% | 7.9% | 7.9% | 8% | Yearly | Yes |

| Sukanya Samriddhi Yojana (SSY) | 7.6% | 8.4% | 8.4% | 8.4% | 8.5% | Yearly | Yes |

| Senior Citizens Savings Scheme (SCSS) | 7.4% | 8.6% | 8.6% | 8.6% | 8.7% | Quarterly and paid | Yes |

Here’s a picture showing additional information on How interest is compounded on these Post office saving schemes? Can you avail a tax deduction under Section 80C of The Income Tax Act, if you invest in these small saving schemes in India?

Post Office Interest Rates Table: 2018-19

Here’s a table showing the Post Office Interest Rates for the past few years:

| Post Office Savings Scheme | Interest rate 1st Apr-30th Jun'18 | Interest rate 1st Jul-30th Sept'18 | Interest rate 1st Oct-31st Dec'18 | Interest rate 1st Jan-31st March'19 | Tax deduction U/s 80C |

|---|---|---|---|---|---|

| Post Office Savings Account | 4% | 4% | 4% | 4% | No |

| Post Office Recurring Account (RD) | 6.9% | 6.9% | 7.3% | 7.3% | No |

| Post Office Monthly Income Scheme (MIS) | 7.3% | 7.3% | 7.3% | 7.3% | No |

| Post Office Time Deposit - 1 year | 6.6% | 6.6% | 6.9% | 7% | No |

| Post Office Time Deposit - 2 years | 6.7% | 6.7% | 7% | 7% | No |

| Post Office Time Deposit - 3 years | 6.9% | 6.9% | 7.2% | 7% | No |

| Post Office Time Deposit - 5 years | 7.4% | 7.4% | 7.8% | 7.8% | Yes |

| Kisan Vikas Patra (KVP) | 7.3% | 7.3% | 7.7% | 7.7% | No |

| National Savings Certificate (NSC) | 7.6% | 7.6% | 8% | 8% | Yes |

| Public Provident Fund (PPF) | 7.6% | 7.6% | 8% | 8% | Yes |

| Sukanya Samriddhi Yojana (SSY) | 8.1% | 8.1% | 8.5% | 8.5% | Yes |

| Senior Citizens Savings Scheme (SCSS) | 8.3% | 8.3% | 8.7% | 8.7% | Yes |

Post Office Interest Rates: Important Points

1. Interest rates on these Post Office schemes are reviewed and fixed every quarter by the Government.

2. You can lock-in the interest rate in a quarter for the entire tenure of some of these Post office schemes only. These saving schemes include:

- Post Office Time Deposit

- Post Office Recurring Deposit

- Post Office Monthly Income Scheme

- National Savings Certificate (NSC)

- Kissan Vikas Patra (KVP)

3. For Public Provident Fund(PPF) and Sukanya Samriddhi Yojana (SSY), the revised interest rates for every quarter shall be applicable. Therefore, the newer interest rates shall apply for different quarters.

Post Office Interest Rates: A Final Take

No doubt, these Post Office Saving Schemes provide a safer investment alternative to the risk averse investors. In addition to it, a decent fixed return is the main point of attraction towards such saving schemes.

Moreover, the tax benefit associated with many of these Post Office Schemes is definitely going to attract investors in future as well.

Therefore, looking at the market volatility and uncertain returns of other long term investment options in India, these Post Office Saving Schemes surely have advantage for the safe players.

What do you think? Do you like investing in Post Office Saving Schemes? If yes, which one do you prefer? Are you satisfied with the new interest rates being offered on these Post Office Schemes? Or do you wish to get still better returns on the Small Saving Schemes in India? Feel free to share your opinions on the same below or you may join our free investment discussion forum.