We often get confused when it comes to selecting the best credit card from a whole bunch of credit card options that are available in India. There are a number of queries that come to our mind while choosing the right credit card that suits our needs. So, here I shall be highlighting one such credit card: Standard Chartered Manhattan Platinum Credit Card, a card that qualifies in our list of popular and Best Credit Cards in India.

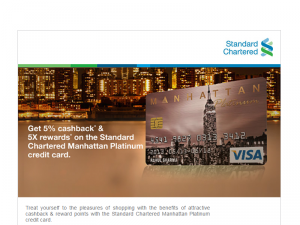

Standard Chartered Manhattan Platinum Credit Card: A Glimpse

Sharing my own personal experience, I was in a dilemma while choosing my credit card that particularly suited my individual needs. Actually, I am pretty fond of shopping especially grocery and other stuff. So, here I shall be sharing with you my personal opinions and feedback on Standard Chartered Manhattan Platinum Credit Card.

Keep reading!! Grab deeper insights and some exclusive details based on my personal experiences on the Standard Chartered Manhattan Platinum Credit Card.

This is one credit card that you need in your wallet, if you are a shopping freak and love buying some cool stuff. So, the Standard Chartered Manhattan Platinum Credit Card is what you will become fond of after getting some really great cashback and reward offers.

Let’s talk a bit more about Standard Chartered Manhattan Platinum Credit Card. One thing that makes it unique and different from other credit cards is the 5% cashback that you get on supermarkets and departmental stores.

That’s pretty cool, not all cards give you such a great feature. In fact, this is what initially attracted me towards this particular credit card.

Besides, cashback some other features also make it a great choice amongst credit card users. The best thing is that you can apply online easily.

All you need is to fit the eligibility criteria, have a good credit background and there you go, after requisite verification, documentation and processing you can get hold of this credit card.

Let me sum up all the key benefits of this credit card and why it has been in my list of best credit cards in India.

Standard Chartered Manhattan Platinum Credit Card: Benefits

1. Annual fee:

The joining fee for is Rs.999 and the annual fee is Rs.999 only. But, wait if you spend in excess of Rs.120000 in a year, you might get joining fee waiver as well. So, you can enjoy waiver of renewal fee also.

2. 5% cashback on shopping at Departmental Stores:

We all do spend a fair amount on shopping every month. Here, is a major plus point, you get 5% cashback if you shop at departmental stores and supermarkets. After all you might have heard “A penny saved is a penny earned “ right.

Still thinking!

3. Other Rewards:

You also get 3x Rewards per every Rs.150 spent when you use your Manhattan credit card on other expenses.

4. Special offers:

There are special offers running on this credit card like:

- Travel: Get upto Rs.1000 off on SpiceJet, another special offer that makes this credit card stand out from the rest. Offer for a limited period only.

- Get 15% off on Samsung mobiles.

- Get Rs.1200 off on domestic flight bookings through GoIbibo.

- Additional reward points can be availed on registering for online banking.

- Other cash back and discounts may be offered from time to time.

- There are exclusive visa platinum offers as well.

5. Other Convenient digital payment options:

The digital payment options accompany most of the Standard Chartered credit cards.

If you are looking for a free credit card, you can checkout the Standard Chartered Platinum Rewards Credit Card that has no joining fee and no annual fee as well.

Standard Chartered Manhattan Platinum Credit Card: A Final Take

Standard Chartered Manhattan Platinum Credit Card is a good option for salaried class, small traders, housewives. An ideal fit for people who love spending a lot on groceries, getting cashback and rewards frequently. It is good for people whose annual spending is Rs.1 – 2 lakhs.

Credit card providers have certain eligibility conditions out of which the age of the applicant, the income of the applicant and your credit background are of utmost importance.

Moreover, these days the credit card application process is quite simple and you can do so online, where the customer support shall get back to you and help you in getting the credit card of your choice.

If you clear all the verification checks and are found suitable, you can expect to get your credit card from 7-15 days of submitting your complete documents.

See for yourself if this credit card suits your needs and fits your choice, if yes, you can easily apply online right now.

Ideally Standard Chartered Manhattan Platinum Card is a popular choice and the best credit card in India if you are looking to earn cashback and rewards. Further, this credit card is a good choice for grocery shopping plus various other added benefits that include easy payment facilities for fuel, utilities etc.

Take an informed decision after analysing all the features and benefits the credit card shall offer you.

The views expressed here are my personal and individual preferences may vary from person to person based on the various factors like age, priorities, usage, income and experiences of an individual.

Have you used the Standard Chartered Manhattan Platinum Credit card? Do share your valuable experiences and feedback on the same? If you have any other credit card to add to our list of best credit cards in India, feel free to mention it in the comment section below.

A must read: 5 Best Cashback credit cards in India

The details are on “as is” basis, there might be changes in the features and benefits of the credit card from time to time. Please check all the Terms and conditions (T&C) carefully with the respective banks/companies while applying for any of the best credit cards in India.

Hi,

Which all supermarkets are covered in this? Details

To get 5% cash back I have to spend at least 1000.

So my question is

What if I buy grocery purchase of only 500? will I get rewards point at 5X or at least I will get reward points at 1X (i,e 15rupees = 1 point), or nothing at all.

Hi,this is a good credit card.I have been using it for some time now.Got some decent offers.Just remember to pay your dues on time for any credit card that you have.