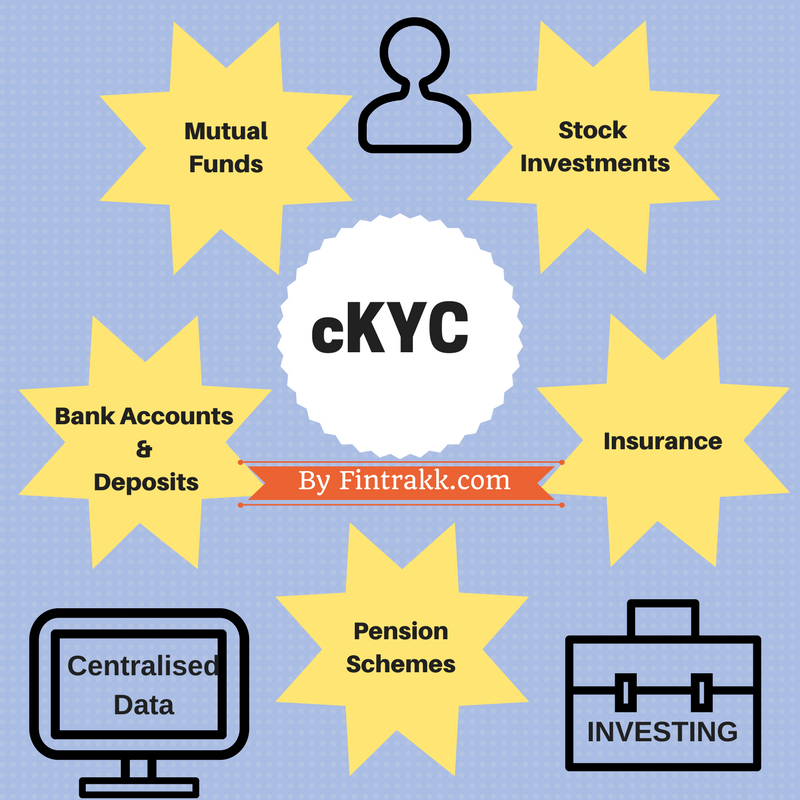

Through this blog we shall make you familiar with cKYC or Central KYC. After reading through it, you will probably get an answer to all your queries like: What is cKYC or Central KYC? What is meaning of cKYC? How to get cKYC or Central KYC done? How cKYC is different from KYC? How to check and update cKYC? And all that you want to know about this important terminology in detail.

What is KYC?

To start with, KYC stands for Know Your Customer and cKYC stands for Central KYC. In simple words, KYC is a process through which institutions like banks, mutual fund companies, insurance companies, stock brokers etc. collect certain information from the clients that reflect the unique identity of such clients. The individual identity of a person is verified based on the details and documents provided by the individual.

This is a regular process followed in order to prevent any kind of financial fraud, money laundering or identity misrepresentation. The main objective behind KYC is that financial institutions should know their customers properly and be able to identify any unusual or suspicious behaviour at the very first step itself.

You may also like: Best Demat and Trading Account in India

What is cKYC or Central KYC?

Earlier, you were supposed to be KYC compliant with multiple institutions say banks, mutual fund houses and insurance companies etc. again and again. So, if you thought of opening a bank account or investing your money, you had to follow a tedious KYC process, that too separately with each of these financial institutions.

Before the introduction of cKYC or Central KYC, there were separate KYC formats for different financial institutions like banks, mutual funds houses etc.

This involved a lot of documentation and became a cumbersome job both for the customer as well as the companies. So, in order to reduce the compliance burden and make the whole process much simpler, the Government introduced cKYC or Central KYC in July 2015 which means that a single KYC is sufficient to invest in different financial products by different regulators.

From 1st February,2017 onwards all the new investors who wish to invest their money in mutual funds have to get cKYC done. The earlier KYC shall be replaced by new cKYC or Central KYC. However, just relax…no updation is required on part of the existing mutual fund investors. If you are already KYC compliant, you need not apply for cKYC.

In cKYC, all the customer information shall be stored at one central server that is accessible to all the financial institutions. cKYC is managed by Central Registry of Securitization and Asset Reconstruction and Security Interest in India (CERSAI).

Also go through Best Trading Platform in India

Hence, cKYC is the central repository of KYC records of all customers in the financial sector. The individual KYC records are stored in a digitally secure electronic format and can by obtained by institutions and they don’t require to do the KYC process of the same individual multiple times. So, easy data de-duplication can be done to ensure a single KYC identifier per applicant.

Simply stating, if you have completed the KYC process with any one financial institution, there shall be no need to do the whole process all over again with any other institution. This single KYC representing your identity refers to cKYC or Central KYC.

For Example: If you have completed KYC process once while opening your saving bank account, you need not get it done again while investing in mutual funds or elsewhere.

What is the difference between CKYC, eKYC and KYC?

It is necessary to understand these three versions of a process which needs authenticating customer identification.

CKYC

It is an initiative taken by the Government of India where the aim is to have a structure in the plan which allows investors to fill in the details only once to carry out multiple transactions across different financial institutions and it will allow for larger market participation by investors.

eKYC

eKYC stands for electronic know your customer. In this KYC done with the help of the investor’s Aadhaar number. The authentication can be done in two ways, either by OTP (one-time password) or by biometrics. This verified data is uploaded into the records of the KRA database.

KYC

For opening a bank account or mutual fund or buy an insurance policy the individual needs to furnish several details in the prescribed form along with required documents. Then these financial institutions make use of an IPV (in-person verification) which verifies all the documents and identity of the person submitted along with KYC form. Once the verification is done, the data and attached documents of the respective individual are uploaded to the KRA database (KYC Registration Agency).

Role of Financial Institutions in cKYC :

The financial institutions can register online at ckycindia.in by providing the complete details and submitting the requisite documents to Central KYC Registry.

Financial Institutions have to pay an advance fee to CERSAI, the requisite fee shall be deducted based on the usage. The authorised institutions can de-duplicate data and find out if the customer is cKYC compliant. cKYC further helps in reducing the costs by avoiding multiplicity of data and record keeping.

Financial institutions need to upload client’s KYC data within 3 days of onboarding a client.

Further, if cKYC details are updated by any one entity, the other entities can get a real time update.

How to Get cKYC Done?

You need not worry much about How to get cKYC done, the reason being that whenever you think of opening a bank account or investing in any financial products, the financial institutions shall themselves ask you to get your cKYC done. It is just a simple process where yo need to provide the information as required.

You as an individual need to submit a cKYC form (new cKYC form) duly filled and signed and the requisite self attested supporting documents as well.

Documents Required for cKYC

The valid supporting documents that act as a proof of identity and proof of address are :

- Passport Copy

- PAN Card Copy

- Aadhar card

- Voter ID

- Driving license etc.

The photocopies of the documents shall be physically verified and in person verification of the customer shall also be done.(FATCA declaration is also included in the new cKYC form with some other important changes replacing the earlier KYC form).

Also read: Mutual Funds vs. Stocks vs. Bonds – Difference

Once you complete the cKYC process, you shall be allotted a 14 digit unique identification number called KIN or KYC Identification number. What you need to do is, just provide this KIN whenever you make a new investment in any of the financial products and with any other financial institution.

Now, this sounds really cool…If you get cKYC done once, you won’t have to go through the whole complex procedure again anywhere with any financial institution.

If you get this verification and documentation completed once and become cKYC compliant, your investing journey will become much easier. So, if you are cKYC complaint that will be sufficient if you invest with any other financial entity, you won’t have to do the whole procedure again.

It seems to be a great initiative to move investors to a single KYC platform known as cKYC or Central KYC. A simplified process and a single KYC for all your financial transactions is indeed a welcome step for the benefit of the investors.

How to Check CKYC Number Online?

Once verification completed, you can easily check your CKYC number through any financial services institute by following few simple steps:

- Firstly, log on to any financial service company website that provides CKYC check.

- Fill in your PAN number.

- Proceed with entering the security code displayed on the screen.

- Finally, your CKYC number is displayed.

For further use, you can note down your CKYC number. This could save a lot of your time while investing with any financial institution.

Not to miss out, a detailed guide on Stock Market Basics for Beginners

How to Update CKYC?

To update your CKYC status online you have to follow few easy steps:

- Firstly you have to download the ‘KYC Details Change Form’ (this is for individuals only) from camskra.com.

- Then fill the field you would wish to update and submit it to an authorised intermediary which could be a bank, stockbroker, insurance company, or a mutual fund company.

- In the last, the intermediate upload the data in the system of KYC – KRA or registration agency that is associated with it.

- Once it’s updated you can also do the CKYC status check online.

KRA (KYC Registration Agency) is registered with SEBI under the KYC Regulation Act of 2011. These agencies are responsible for maintaining your KYC records. By visiting any KRA website you can check KYC status online by entering your PAN number. KRA agencies currently registered with SEBI are:

- CAMSKRA, set up by Cams

- Karvy KRA (BY Karvy)

- CDSL Ventures Ltd., a division of CDSL

- NSDL Database management Ltd., a subsidiary of NSDL

- DotEx International Ltd., a unit of the National Stock Agency

cKYC or Central KYC: Final Thoughts

We are living in the modern world so we want things to happen in a matter of a few minutes. The old process of starting a financial relationship with a financial firm was wearisome and we had to submit KYC documents. However, with the introduction of CKYC registry, the documentation process has become quicker, easier and most importantly, safer.

Looking for some great investment options, do have a look at our popular blog post: 7 Best Long term Investment options in India

Have you got your cKYC done? What are your views on cKYC replacing KYC? How do you consider this important and impressive move? Feel free to share your valuable feedback or any queries thereon in the comment section below.

I having CKYC Number for Mutual funds.The same CKYC number can I use for bank KYC purpose ?

I am an existing mutual fund investor. Can I go for CKYC? In Sept 2017 I had handover Supplementary CKYC form along with KYC documents to my Bank, but nothing happened. Which form should I submit for CKYC ? CKYC form or Supplementary CKYC form? Please guide.

Nice and detailed post. cKYC is a pre-requisite these days even while opening a bank account.

This seems to be a good move.A single KYC makes the process of investing simple.These days AMCs themselves get the KYC done,you just need to submit requisite documents.

Thanks, very useful info on Voluntary PF.Nicely explained. cKYC is for the benefit of common man only.

It is a good way forward for Indian markets as avoiding the duplication of KYC process will certainly attract more investors.

The meaningful and due answer in the form of clarifications may be provided to me by authorities in this matter of queries.

It is requested to reply my queries on my gmail Id.

1) Among resident Indian citizens who are eligible for CKYC?

2) Can OCI(Overseas Citizen of India) and US GREEN CARD HOLDERS OF Non Resident Indian citizens apply for

CKYC? What is about their entitlement and eligibility for CKYC?

Hello Sir,

All Resident Indians are required to get KYC done while doing any monetary transaction like opening a bank account or while investing money in India. Earlier there were multiple forms to be submitted to different financial institutions. But, now a single cKYC or Central KYC can be done. Suppose, if you plan to open a Savings Bank account or you are a first time mutual fund investor or you wish to open a Demat account, then you need to submit the new cKYC form to your financial institution. The bank or other financial institution shall ask for the necessary details to get your KYC done.

Regarding, OCI and US Green card holders there might be certain additional requirements like FATCA Compliance (Foreign Account Tax Compliance Act) the new cKYC form also captures FATCA Compliance details.

You need to check with the respective institution about the additional requirements, documents required etc. The general requirements include submission of cKYC form,ID proof,address proof copies,photograph etc.

Thank you sir

You are welcome sir. Happy to help 🙂 Keep visiting for any further queries and to check our latest posts 🙂