SAVING AND INVESTING….two very important words that you tend to hear these days. You tend to get confused as to How to start investing your money, that too at the right time and in the right manner.

“Spend less and start saving” is a common advise that youngsters usually get from elders.

When people advise you to save and invest at a young age,what do they actually mean?

It is just that experienced people or the ones advising you have probably gone through different stages of life. They know the importance of saving and investing at a young age. You can get to learn a lot from their personal experiences and advice, that will surely help you in avoiding mistakes.

You just need to choose the right path and you will approach your goals in an easy manner.

So, first of all, the biggest investment that you can make at an early stage is towards your Education and Enhanced learning skills that shall accompany you throughout your life.

“Invest in yourself. Your career is the engine of your wealth.” – Paul Clitheroe

So, if you build up a successful career based on your education, talent and skills, you can anyways build wealth in the long run.

Regarding saving, it is a great habit to save, no matter how small the amount is, it is always advisable to save some of your money, if possible out of your pocket money as well. This habit of Small saving initially shall convert to huge savings and investments as you grow in years.

Now, if you are a young person, starting a career, having no major obligations and incurring only nominal expenses. You can afford to save a fairly big amount out of your earnings.

To get exclusive financial tips on how to save your money you can refer: How to save money – 7 tips only smart people know!

At a young age,you can anyways increase your risk appetite and widen your investment horizon.Consider a person in his late 30s or early 40s :Will he be able to take as much risk while investing as a 20–22 year old person can take ?

Moreover, a person who starts investing at a later stage has to contribute a bigger sum to build the same amount of corpus as compared to the one who started saving in his early age.

Have you heard about the legendary investor “Warren Buffet” he still spends 80% of his day reading. That’s really amazing…Now, if you want to learn more about this great investor and his investing ways, do have a look at the famous book: The Snowball Warren Buffett and the Business of Life

Now, Investing at a young age does not necessarily mean that you have to buy stocks or invest in real estate…there are various other ways and things to be considered as well. Keep reading and you will get to know…

So, here is a complete list of important points that you should keep in mind before investing your money. You can simply state them as the “INVESTMENT BASICS” that you should be aware of while investing.

Firstly,you need to get an answer to the following queries:

For what you want to invest? What are your financial goals? How much money you can actually save and invest? And for how much time period you want to invest? Above all, how much risk you can afford to take?

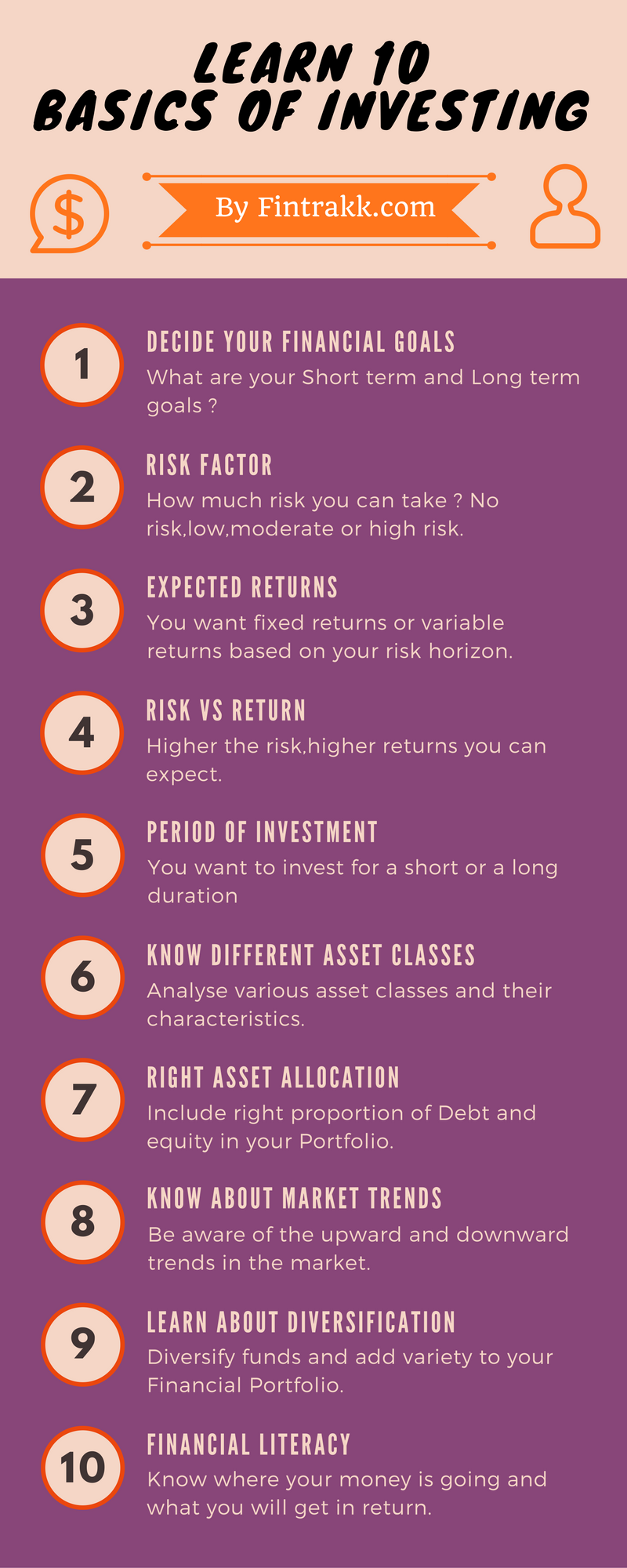

Learn the following 10 Investment basics that will surely help you in a smooth Investment journey.

How to start Investing your Money? Tips for Beginners

Before investing your money keep in mind the below mentioned 10 Basic Investing tips for Beginners that will help you throughout your investment journey.

1. Your financial goals:

What is your purpose of investing? Decide your financial goals i.e.you have Short term or Long term financial objectives. Short term varies generally from 1 year to 3 years.Long term goals can range between 3-10 years or even beyond that as per your priorities.

To have a deeper insight on Investments,you can have a look at our popular blog posts: 7 Best Short term Investments and 7 Best Long term Investments in India!

2. Risk factors:

Risk basically is a term used for saying that there is no surety of returns. So, how much risk you are willing to take? No risk, low risk, moderate risk or high risks. This is totally your personal choice as to how much risk you are willing to take. What is your acceptable level of risk, that you need to decide.

3. Expected Returns:

You are looking to invest your money for getting fixed returns and are happy with it. Or you want to get higher returns by taking some risk.e.g.Conservative investors who don’t want to take any risk are satisfied even with low but fixed returns.This is quite acceptable based on one’s requirements, age and risk horizon.

On the other hand, some investors want to yield very high returns by taking high risks as in the case of stock markets.

4. Risk vs Return:

Risk and return are directly correlated i.e. higher the risk,higher the returns you can expect. But, returns on investments like mutual funds, shares etc. are based on market fluctuations. So, higher risk just gives you an opportunity to get good returns in the long run but the returns are not assured in any case.

5. Period of Investment:

You want to park your funds for a short term or long term. This is based on the type of financial objectives you have. Your investment duration can vary from few days to months to years as per your requirements and surplus funds that you have.

But,if you have surplus funds,it is advisable to plan for your long term investments and build a corpus to lead a good after retirement life.

6. Know about different Asset classes:

Financial instruments/alternatives falling in the same asset class enjoy similar characteristics. Have a detailed analysis on the various asset classes and plan your Investments wisely.

There are basically 5 broad asset classes :

- Cash or cash equivalent

- Fixed Income

- Real estate

- Equity

- Commodities

Decide the asset class you want to invest in based on your risk appetite and investment horizon.

You can follow our blog post: What are different asset classes? A complete guide for you to gain knowledge on the different asset classes to invest.

7. Right Asset Allocation:

The right asset allocation is one important factor to be considered while designing your Investment portfolio. How much Debt and equity portion to invest in? How much funds to put in fixed/less risky investments as compared to riskier ones.

As a general rule, various experts advise to allocate your funds on the basis of your age i.e. invest in debt a percentage equal to your age and the rest in equity.

e.g. If you are 30 then you can invest 30% of your funds in Debt or fixed income securities and rest 70% in equity or equity based schemes. But, this is just a general rule and not any kind of professional advice. You can always adjust your portfolio according to your own requirements.

8. Be aware of the Market trends:

Market trends basically refers to how the financial markets move. You may see an upward trend or a downward trend based on the latest happenings all around. So, if you have invested in say mutual funds or direct equity,you need to have information about the market trends that are likely to affect your investments.

It is common to hear that “Mutual funds and stocks are subject to market risks” since their returns are based on market fluctuations. So, you need to be cautious especially in equity based investments.

To catch up the latest details on trading and investing, you may also like to have a look at Best Stock Market Trading Apps in India

9. Learn about Diversification:

“Don’t put all the eggs in one basket” is a common saying that can be used in this context. This means try to diversify your funds in various investment options rather than sticking to one type of investment. Add a variety to your Financial portfolio by including a mix of various financial instruments.

Have a diversified portfolio comprising of :

- Short term investments and Long term investments

- Fixed interest bearing and slightly riskier ones to get higher returns.

10. Financial Literacy:

You can take the help of a Financial advisor to plan your Financial portfolio but firstly you should make yourself financially aware. You should at least know the financial basics so that you can keep a track of your finances and know exactly where your money is going and what you will get in return.

The more you read,the more you can add to your knowledge on finance related topics. Read and do your own research. You can increase your knowledge by referring to various available sources like personal finance blogs, investment books, periodicals, articles on different websites and news sites etc.

Join a good financial forum to become a part of healthy discussions and gain feedback from others.

Here are some interesting books that have helped beginners to enhance their knowledge on Investing. These might help you as well…

This list of books contains affiliate links, I might be earning a small commission if you purchase. Thanks for supporting my blogging adventures !

As you keep on adding to your knowledge, you will become familiar with the Investment strategies.These things can be learnt over a period of time only,through your own experience. You can anyways refer some great books by famous authors like the ones mentioned above and become a smart investor.

You may also like to explore : 10 Best Stock Market Books for Beginners !

Start small and then slowly and gradually increase your investments especially in the riskier options.

Add a combination of the following to your Financial portfolio:

- Secure options for capital protection

- Risky ones but good for growing your money-subject to market risks

Moreover, having patience and a diversified and updated set of knowledge is the key to success.

Important note: Don’t forget to take adequate risk cover in the form of Health Insurance and Term Insurance to protect your family. Consider insurance as an essential part of your financial portfolio and not just another investment option.

Consider Insurance & Investment as two separate parts of your Financial portfolio. Never expect high return from insurance policy, insurance is not for return. Insurance is to provide financial security to your family. While Investment is to grow your money and get high returns.

Also, if you go for trading or investing in stock market, be cautious and do proper research while putting in your money.

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” – Robert Kiyosaki

So,have a Balanced Portfolio and enjoy good returns!

At a young age, you can take greater risk to earn high returns but be very careful and plan your investments in the right manner.

To grab more details on Investing at young age you can refer 10 Financial Planning Tips to follow in your 20s!

If you are from India, and just want to have a deeper insight on Finance & Investment tips,you are at the right place. Just go through our blogs on finance and investments @ Fintrakk.com that provide exclusive finance and taxation tips to the common man.

Feel free to add your valuable feedback!

Did I forget to mention something? Any important points you need to add upon to the investing guide for beginners? Any suggestions or investing basics to add here? Do you have any exclusive tips or experiences on how you started your investing ? Go ahead and share them in the comment section.

More stronger the basics (roots) more better and healthier are the fruits.Invest more time to learn the basics.

Saving will always be useful to you as an emergency fund.You never know when you are in need of it for that just list out all your expenses and start investing your money. I really need to follow all the listed Basics of investment.Thank you!!!

Investing tips are very important so that one can know how to invest. I think it’s really a good idea that you shared these here.Thanks.

Thanks for the information.It would be nice if you can give Financial Plans for various types of people of different age groups,salaried people or even those who are unemployed or those who live on FD income only and various other types of people.

Sure,we shall discuss investing options for people of different age groups in our upcoming blog posts.Stay tuned for latest topics.

Hey I would like to learn about high frequency trading as a career choice. I am currently pursuing BTech in computer science an would like to have gain some finance knowledge.

Therefore it would be of great help if you could mention name’s of some books.

Hi,its good to hear about your interest in investing and increasing your financial knowledge for the same.You seem to be a beginner in investing, so just be careful and make yourself fully aware about the risks associated with different investments.

You can refer books like “Everything you want to know about stock market investing” and you can checkout some other books at http://fintrakk.com/10-best-personal-finance-investing-books-for-you-to-read/