Stove Kraft Ltd. is all set to hit the capital market very soon. So, we thought of sharing Stove Kraft IPO Review covering details about its listing, subscription and allotment. You’ll get a complete overview of the kitchen appliances giant and an in-depth analysis of its upcoming initial public offering.

STOVE KRAFT LIMITED: Company Overview

Incorporated as Stove Kraft Private Limited on June 28, 1999, the company was converted into a public limited company Stove Kraft Limited officially on August 13, 2018. The ISO 9001:2008 certified company is one of the leading brands of India for kitchen appliances, a dominant player in pressure cookers and a market leader in the sale of free standing hobs and cooktops.

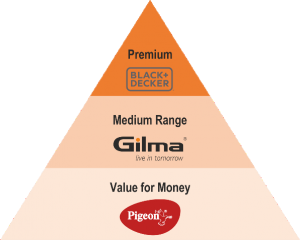

The company is engaged in the manufacture and retail of a wide and diverse suite of kitchen solutions under “Pigeon” and “Gilma” brands. Further, it also proposes to commence manufacturing of kitchen solutions under the “BLACK+ DECKER” brand, covering the entire range of value, semi-premium and premium kitchen solutions.

Stove Kraft Limited does not have a holding company or any subsidiary.

You may also like: CAMS IPO Review

Stove Kraft Limited: Products Offered

As of August 31, 2018, company’s “Pigeon” branded products contributed 81.61% to overall sales. Of course, the most popular brand! For fiscal year 2018 and 2017, “Pigeon” branded products contributed 86.89% and 86.86% to overall sales respectively. No doubt, it enjoys a leading position in the market for certain products such free standing hobs, cooktops, non-stick cookware, LPG gas stoves and induction cooktops.

Similarly, company’s “Gilma” branded products contributed 4.74% to overall sales “BLACK + DECKER” products contributed 0.88% to overall sales as of March 31, 2018.

The products currently offered under “Pigeon” brand are as follows:

| Cookware | Cooktops and other kitchen solutions | Small appliances | Other products |

|---|---|---|---|

| • Pressure cookers • Titanium hard anodized cookware • Wondercast cookware • Non-stick cookware • Electric rice cookers | • Pressure cookers • Glass cooktops • Stainless steel cooktops • Induction cooktops • Chimney | • Mixer Grinders • Rice cookers • Electric kettles • Toasters • Sandwich makers • Knives • Roti Makers • Steam irons • Juicers • Food steamers • Air fryers • Electric grills | • Emergency Lamps • Water bottles and flasks • Aluminium ladders • Cloth dryers • Water heaters • Dustbins • Mops |

Key Strengths of Stove Kraft

- You’ll get a one stop shop for kitchen solutions brands.

- There has been a boost in sales by 5crore LPG connections under Pradhan Mantri Ujjawla Yojna (PMUY).

- Focus on LED lighting products.

You may also read on NSE IPO Review: Date, Price, Size & Details

Key Risks of Stove Kraft

- Pigeon brand name is under litigation.

- Increasing competition from local brands.

- Negative cash flows in the past.

Stove Kraft Ltd.: Competitive Strengths

- Well-connected distribution network.

- Dedicated after sales network.

- A Strong manufacturing capability.

- Consistent focus on quality and innovation.

- Professional management with extensive experience.

- A Young and dynamic workforce.

- Strong and stable financial track record.

Stove Kraft Ltd. Team

Now, let’s gather some information about the Stove Kraft team, including its promoters, directors and its management.

Promoters

Rajendra Gandhi and Sunita Rajendra Gandhi are the promoters of the company.

| # | Name | Role | Age(in yrs) | No. of equity shares | % of shareholding |

|---|---|---|---|---|---|

| 1 | Rajendra Gandhi | Promoter | 50 | 18,184,619 | 73.57 |

| 2 | Sunita Rajendra Gandhi | Promoter | 47 | 259,300 | 1.05 |

- Rajendra Gandhi (DIN: 01646143), aged 50 years, is the Managing Director of the company. He is a resident Indian national and is a partner of Stovekraft India.

- Sunita Rajendra Gandhi (DIN: 01676100), aged 47 years, is a resident Indian national. She is not involved in the day to day management of the company and in any other venture. She is also not a director in the company.

You may also like to review Upcoming IPOs in India

Directors

The company has 6 directors mentioned in the table below.

| # | Name | Designation | Age(in yrs) | No. of equity shares | % of shareholding |

|---|---|---|---|---|---|

| 1 | Rajendra Gandhi | Managing Director | 50 | 18,184,619 | 73.57 |

| 2 | Neha Gandhi | Executive Director | 25 | 1 | 0 |

| 3 | Bharat Singh | Nominee Director | 40 | 0 | 0 |

| 4 | Rajiv Mehta Nitinbhai | Nominee Director | 40 | 0 | 0 |

| 5 | Lakshmikant Gupta | Independent Director | 50 | 0 | 0 |

| 6 | Shubha Rao Mayya | Independent Director | 55 | 0 | 0 |

- Rajendra Gandhi is the Managing Director of our Company. He has cleared the S.S.L.C. examination conducted by the Karnataka Secondary Education Examination Board. He is the founder of the Company and has been on the Board since 1999. He has an experience of over 19 years and is involved in the day to day affairs of the Company.

- Neha Gandhi is an Executive Director of the Company. She holds a bachelor’s degree in business administration from Christ University, Bengaluru and has completed a post graduate certificate programme in sales and marketing management from. She has an experience of over two years of working with the Company.

- Bharat Singh is a nominee Director of SCI and SCI-GIH on the Board of the Company. He holds a bachelor’s degree in commerce from the University of Delhi and is a chartered accountant with the Institute of Chartered Accountants of India. He has previously worked as the chief financial officer of Ibibo Group private Limited and SBI Business Process Management Services Private Limited.

- Rajiv Mehta Nitinbhai is an Independent Director of the Company. He holds a bachelor’s degree in chemical engineering from University of Mumbai and master’s degree in science from University of Pennsylvania, and in business administration from INSEAD. He has previously served as the chief executive officer of Arvind Limited.

- Lakshmikant Gupta is also an Independent Director of the Company. He holds a bachelor’s degree in economics from Hans Raj College, University of Delhi and a post-graduate diploma in business management from Institute of Management Technology, Ghaziabad. He has previously been associated with Ibibo Group Pte Limited, Procter & Gamble Gulf FZE, LG Electronics India Private Limited and Girnar Software Private Limited.

- Shubha Rao Mayya is an Independent Director of the Company. She holds a bachelor’s degree in commerce from the University of Mumbai and is a chartered accountant with the Institute of Chartered Accountants of India. She has previously worked with ICICI Limited, ICICI Prudential Life Insurance Company Limited and Tata Consultancy Services Limited. She also serves as a Director on the board of Ace Manufacturing System limited.

Get a complete and exclusive review on Burger King IPO: Date, Price & Details

Stove Kraft Ltd. Management Team

The company has 4 key management personnel.

- Shashidhar SK is the Chief Financial Officer, Company Secretary and Compliance Officer of the Company. He holds a bachelor’s degree in commerce from Bangalore University. He is a Chartered Global Management Accountant (CGMA) and Fellow Chartered Management Accountant (FCMA) as certified by the Chartered Institute of Management Accountants(“CIMA”). He has over 25 years of experience in the corporate finance and corporate secretarial field.

- Venkitesh N. is the Head – Corporate Planning of the Company. He holds a bachelor’s degree in technology from University of Kerala. He has more than 25 years of experience in the manufacturing sector.

- Senthil Kumar R. is the Chief Operating Officer of the Company. He holds a bachelor’s degree in engineering from University of Madras. He has over 30 years of experience in manufacturing.

- Rohit Mago is the Chief Executive Officer of our Company’s manufacturing unit located at Baddi. He holds bachelor’s degree in science from Government Autonomous Science College, Jabalpur, a master’s degree in business administration from Rani Durgavati Vishwavidyalya and a post-graduate certificate in retail management from XLRI Jamshedpur. He has over 18 years of experience in various industries.

You may also like: Best Sites for Indian Stock Market Analysis

Stove Kraft Financials

Stove Kraft: Summary of Assets and Liabilities (in Rs. Cr.)

| Particulars | Reference | As on 31.03.2018 | As on 31.03.2017 | As on 31.03.2016 | As on 31.03.2015 | As on 31.03.2014 |

|---|---|---|---|---|---|---|

| Assets | ||||||

| Total non-current asset | 1a | 197.47 | 200.92 | 207.98 | 205.05 | 178.26 |

| Total current assets | 1b | 197.61 | 152.15 | 133.90 | 144.72 | 166.42 |

| Total Assets | 1c=1a+1b | 395.08 | 353.07 | 341.88 | 349.77 | 344.68 |

| Equity | ||||||

| Equity share capital | 2a | 18.90 | 18.90 | 18.90 | 18.90 | 18.90 |

| Other equity | 2b | -197.55 | -185.11 | -166.13 | -122.94 | -110.20 |

| Equity attributable to owners of the Company | 2c=2a+2b | -178.65 | -166.21 | -147.23 | -104.04 | -91.30 |

| Non-controlling interests | 2d | 0.214 | 0.254 | 0.276 | 0.208 | 0.046 |

| Total Equity | 2e=2c+2d | -178.44 | -165.96 | -146.95 | -103.83 | -91.25 |

| Liabilities | ||||||

| Total non-current liabilities | 3a | 329.54 | 306.72 | 285.53 | 267.53 | 254.58 |

| Total current liabilities | 3b | 243.98 | 212.31 | 203.31 | 186.08 | 181.36 |

| Total Liabilities | 3c=3a+3b | 573.52 | 519.03 | 488.84 | 453.61 | 435.94 |

| Total Equity and Liabilities | 3d=2e+3c | 395.08 | 353.07 | 341.89 | 349.78 | 344.69 |

Stove Kraft : Summary of Profit and Loss ( in Rs. Cr.)

| Particulars | Reference | As on 31.03.2018 | As on 31.03.2017 | As on 31.03.2016 | As on 31.03.2015 | As on 31.03.2014 |

|---|---|---|---|---|---|---|

| Income | ||||||

| Revenue from operations | 1a | 528.95 | 515.03 | 523.27 | 504.16 | 510.17 |

| Other Income | 1b | 5.63 | 2.92 | 1.52 | 2.33 | 4.80 |

| Total Income(top-line) | 1c=1a+1b | 534.59 | 517.95 | 524.79 | 506.49 | 514.97 |

| Expenses | ||||||

| Total Expenses | 2a | 547.88 | 536.92 | 568.23 | 517.39 | 543.64 |

| Profit/ Loss | ||||||

| Profit before tax | 3a | -13.30 | -18.97 | -43.43 | -10.91 | -28.67 |

| Tax | 3b | -0.54 | -0.28 | -0.56 | -1.34 | -1.80 |

| Profit After Tax(bottom -line) | 3c=3a+3b | -12.76 | -18.69 | -42.87 | -9.57 | -26.87 |

| Earnings Per Share | ||||||

| Basic in Rs.(Face value of Rs.10 each) | 3a | -6.74 | -10.17 | -23.31 | -6.57 | -16.15 |

| Diluted in Rs.(Face value of Rs.10 each) | 3b | -6.74 | -10.17 | -23.31 | -6.57 | -16.15 |

Stove Kraft : Summary of Cash Flows ( in Rs. Cr.)

| Particulars | Reference | As on 31.03.2018 | As on 31.03.2017 | As on 31.03.2016 | As on 31.03.2015 | As on 31.03.2014 |

|---|---|---|---|---|---|---|

| Cash Flows | ||||||

| Net cash generated from operating activities | 1a | 11.30 | 29.48 | 19.32 | 34.06 | -30.96 |

| Net cash used in investing activities | 1b | -6.15 | -4.73 | -12.80 | -13.02 | -49.15 |

| Net cash used in financing activities | 1c | -5.30 | -24.62 | -6.44 | -23.42 | 80.13 |

| Net Cash | 1d=1a+1b+1c | -0.14 | 0.13 | 0.07 | -2.37 | 0.02 |

Stove Kraft IPO Objectives

- Repayment/pre-payment, in full or part, of certain borrowings availed by the Company.

- General Corporate Purposes.

Not to miss out, Top 10 Discount Brokers in India

Stove Kraft IPO Dates

| Stove Kraft Ltd. | IPO Details |

| IPO Size | ₹412.63 Cr |

| IPO Type | Book Built Issue IPO |

| Fresh Issue | Equity Shares of Rs.10 totaling up to ₹95 Crore |

| Offer for Sale | 8,250,000 Equity Shares of ₹10 |

| Price Band | ₹384 - ₹385 |

| Minimum Lot Size | 38 Shares |

| Maximum Lot Size | 494 Shares |

Stove Kraft IPO Size, Price Band & Market Lot

| Bid/Offer Opens | Jan 25, 2021 |

| Bid/Offer Closes | Jan 28, 2021 |

| Final Allotment | Feb 2, 2021 |

| Refund Initiation | Feb 3, 2021 |

| Credit of Shares | Feb 7, 2021 |

| IPO Shares Listing Date | Feb 5, 2021 |

So, this was all about Stove Kraft Ltd. IPO. Keep visiting to learn about the Stove Kraft IPO dates, price band, market lots, subscription and allotment details. Are you eyeing on this Initial Public Offering (IPO)? Do you have a query or wish to add your feedback here? Feel free to share your opinions thereon.