Through this blog you shall come to know What is UAN or Universal Account Number? How to get UAN number? As you read further, you will become aware of quick way to get your UAN number and activate the same in an easy and understandable manner.

If you are a salaried employee and contributing towards Employee Provident Fund (EPF), this post might seem to be of your interest. In fact, you can’t ignore UAN presently since all the services of EPFO are now linked to your UAN or Universal Account Number. The whole process of EPF related services has been made online and quite simplified through UAN.

What is UAN or Universal Account Number?

UAN or Universal Account number, as the name itself suggests is a unique identification number, a 12 digit number issued by EPFO i.e. Employee Provident Fund Organisation to its members.

UAN is universal and shall work anywhere i.e. it shall not change with the change in your jobs. This means if you switch jobs, your UAN shall still remain the same.

The main idea behind introducing UAN or Universal Account Number was to reduce the intervention of the employer and give easy access of EPF services to the employees. Easy access to various online services including faster claim settlements are some of the benefits you can get through the online portal.

Let us explain the relevant details, that you as an employee must learn.

How to get UAN or Universal Account Number?

You work as an employee in an organisation. Your employer submits a request for UAN to EPFO. The details of your UAN are provided to your employer by EPFO. Now, your employer further communicates your UAN and Member ID to you. This is how the procedure is normally followed.

1. Get UAN from your employer

In the normal course, you get your UAN from your employer who has obtained the same from EPFO. This is in fact, the simplest way to know your UAN. Get your UAN from your office administration. The employer has the record for all employees and can provide it easily. Once you know it, you can anyways activate UAN on your own by following simple steps.

2. Know your UAN Status

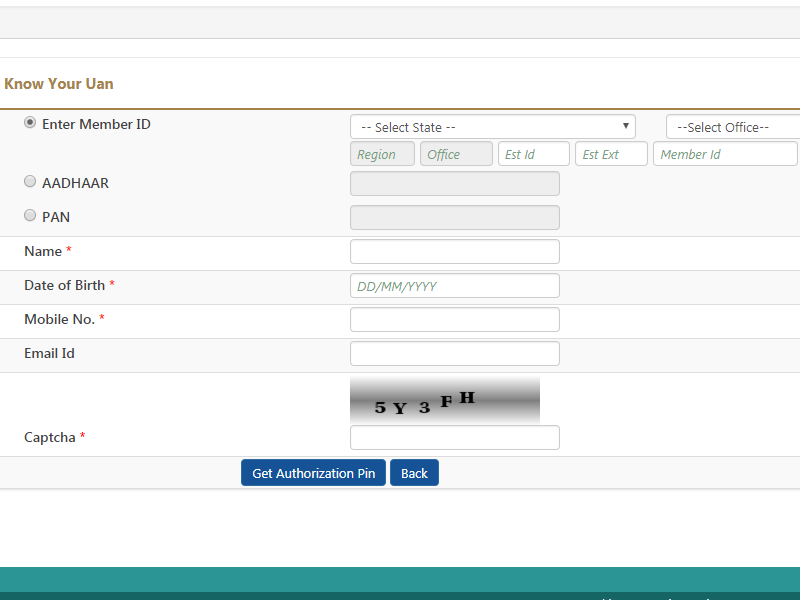

In any case, if your employer doesn’t provide UAN. You can check the status of your UAN yourself also with the following details :

- PF Number: You can get it from your salary slip or from your HR manager.

- Name as mentioned in PF records

- Date of birth

- Mobile number: PIN shall be forwarded on this number, so give a valid number only.

Firstly, you need to check your UAN status at the UAN Member Portal to know if UAN has been already allotted to you, if yes, get that. Otherwise you can generate it, if the same has not been allotted earlier.

Click on Know your UAN Status (link is given at the right corner when you visit the UAN portal). As soon as you click this link, you will see the following screen wherein you need to fill the requisite details:

After submitting the details like PAN, Name, Date of birth, Mobile number etc. you shall be forwarded an authorisation PIN on your mobile number. Fill the PIN and submit the form. You can easily know your UAN status. You shall also receive an SMS stating your UAN number.

Please not that, this procedure applies if you have already been allotted a UAN and you wish to know and verify it.

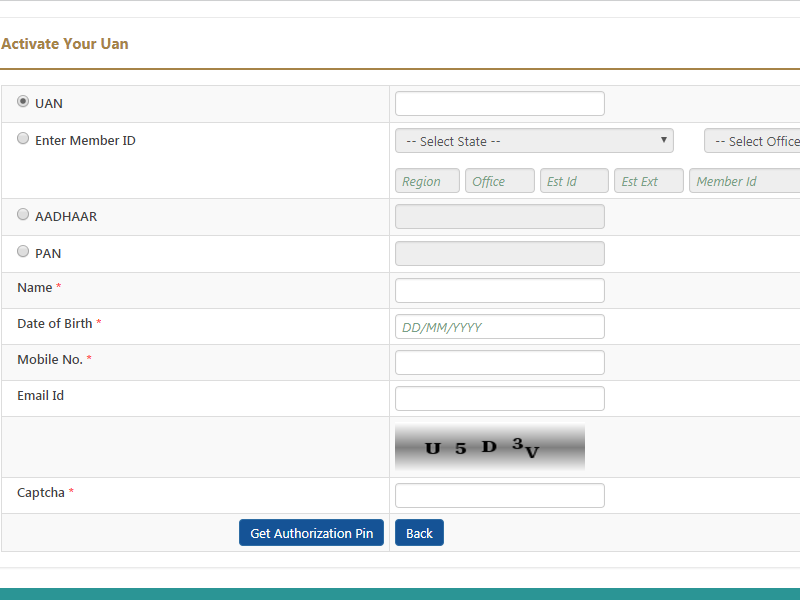

3. Activate UAN or Universal Account Number

Now, when you have got your UAN either from your employer or yourself. The next step is to activate it in order to avail the associated services. Click on Activate UAN at the UAN portal (link is given at the right corner when you visit the UAN portal). Following screen shall appear:

Fill in the required details and activate your UAN instantly, its just as simple as that.

Here, you go…now, when you know your UAN, you can easily login using this UAN and password and have access to the features and benefits at the Unified portal of EPFO.

Benefits of Registration/Activation of UAN Number at UAN member E-sewa portal

- Download E-passbook and know your EPF balance showing Employer contribution,employee contribution and deduction for Employee Pension scheme.

- Transfer your EPF balance.

- Withdraw EPF online in a hassle free manner.

- Link your previous EPF accounts to UAN.

- Upload the KYC details.

- Download Print UAN Card anytime.

- Change mobile number and email address easily.

Further, members who have linked their AADHAR and bank details with UAN can submit PF Withdrawal or claims online. AADHAR submission has been made mandatory in case of online claim submission.

The new Unified Portal of EPFO for Employees and Employers has simplified and strengthened the whole process related to EPF claims/settlement/transfers.

This online user friendly platform has eased out various problems that used to be faced earlier, thereby making things simpler and faster for both the employees as well as the employers.

EPF or Employee Provident Fund is a your retirement fund, your long term savings tool. You have every right to grab all the minute details related to your Employee Provident Fund or EPF. UAN or Universal Account Number is in fact, your unique key to unlock the relevant EPF information as an employee.

You may also like: 7 Best Long term Investment options

What are you waiting for? Are you a salaried employee? If yes, do you make monthly EPF Contributions? Have you got your UAN from your employer?

After reading this,You might have come to know What is UAN? and How to get UAN number? Go ahead, get UAN from your employer and have a look at your EPF details and plan your finances wisely. If you have any queries feel free to share in the comment section below. Any feedback and opinions thereon to enhance our readers interest shall be much appreciated.

Hi,Nice information you have shared.Its very useful for salaried employees.

Thanks for the sharing these details on UAN.Really helpful to us.

This post is very informational. Please add some more details like UAN passbook and withdrawal procedure etc. Thanks for the same.

I have my PF account number. But,I don’t have uan number. So, how can I get my pf amount and also I don’t have PAN card. I have just Aadhar number.Please tell me what can I do.Thanks.

Hi, You can ask your employer or HR team for UAN. They will let you know if it has been generated.

Hi, I previously worked in one company and now the company has closed.I didn’t get my PF account number or UAN number.Is there any process to get it.

Hi I previously worked in one company and now the company has closed.I didn’t get my PF account number or UAN number is there any process to get it.